Artificial Intelligence

Digital Asset Management Market to Reach USD 15.2 Bn by 2032, Asia Pacific Dominates with 34.8% of the Market Share

<!– Name:DistributionId Value:8794098 –> <!– Name:EnableQuoteCarouselOnPnr Value:False –> <!– Name:IcbCode Value:2790 –> <!– Name:CustomerId Value:1269133 –> <!– Name:HasMediaSnippet Value:false –> <!– Name:AnalyticsTrackingId Value:f5005e42-e082-4a14-894c-a30a8b9bb3b2 –>

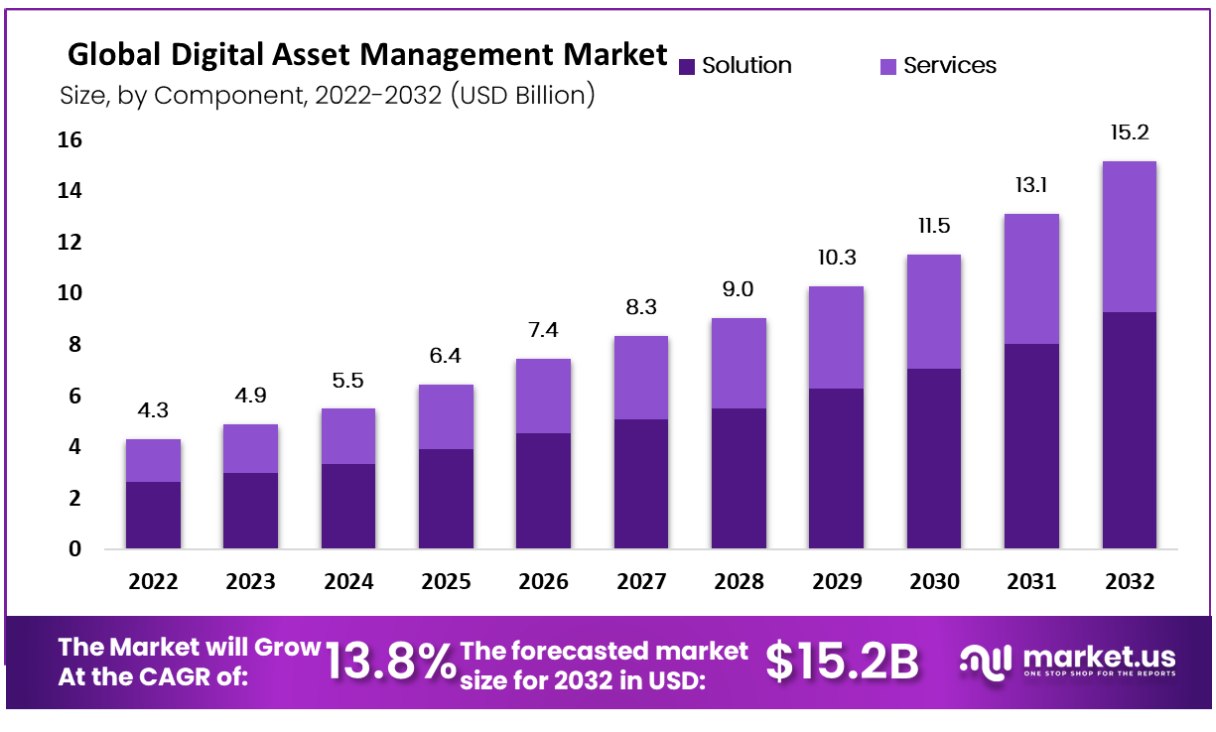

New York, March 23, 2023 (GLOBE NEWSWIRE) — The global Digital Asset Management market size accounted for USD 4.3 billion in 2022, and growth is estimated to accelerate at a CAGR of 13.8%, registering an incremental revenue of USD 15.2 billion by 2032. Digital Asset Management is part of information and communications technology which offers software, services, and systems solutions to analyze and manage the data for the user companies.

Digital asset management allows users to review and edit the data of companies. The rising applications of data asset management in various end-use industries like healthcare, BFSI, IT and telecommunications, and many other industries are fueling the growth of the digital asset management market across the globe.

To get additional highlights on major revenue-generating segments, Request a Digital Asset Management Market sample report at https://market.us/report/digital-asset-management-dam-software-market/#requestSample

Key Takeaway:

- By Component, the solution segment leads the market with a major share of the market in 2022.

- By Deployment, the on-premises segment dominated the overall market in digital asset management with the largest market share in 2022.

- By Business Function, the information technology segment covers a major share of the digital asset management market with the largest market share in 2022.

- By End-Use Industry, the IT and telecommunications industry is expected to grow favorably during the forecast period of 2023 to 2032.

- In 2022, Asia Pacific dominated the market with the highest revenue share of 34.8%.

- North America is estimated to be the most lucrative market in the global digital asset management market in 2022.

Digital asset management is eventually being adopted by users in various industries to store and secure files to complete their work in a given time. The growth of DAM technology is driving organizations to apply these solutions along with collaboration, governance, digital storage, and asset-tracking services. Also, DAM helps users to develop better marketing and branding strategies. Therefore, it is being adopted by more and more users for its social media integration. These all factors are propelling the growth of the digital asset management market through the forecast period of 2023 to 2032.

Factors affecting the growth of the Digital Asset Management industry?

There are several factors that can affect the growth of the digital asset management industry. Some of these factors include:

- The trend of digitization: developing inclination and implementation of digitization across the globe are among the key factors driving the growth of the market.

- Increasing use of cloud-based services: cloud DAM solution improves access to digital assets and increases adaptability and operational speed. As a result, it is rapidly gaining popularity with consumers around the world

- Integration of AI in DAM: artificial intelligence is used in digital asset management to organize and assist large amounts of data. It is expected to drive the growth of DAM through the forecast period.

- Rising use of metadata: metadata is a basic part of digital asset management that helps clients or organizations to find the required data and resources. It is driving the growth of DAM.

- Increasing adoption in the food sector: With the growing trend of social media and visuals in the food and beverages sector, the demand for digital asset management is also rising with it.

To understand how our Digital Asset Management Market report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/digital-asset-management-dam-software-market/#inquiry

Top Trends in Global Digital Asset Management Market

Cloud Digital Asset Management balances the management and delivery of digital media across businesses. Cloud digital asset management also assures to reduce functioning costs and improve productivity while providing a single source for maintaining brand identity. Cloud digital asset management also impacts the front-end experience. Hootsuite Inc. announced its collaboration with Bynder, a commonly used social media management platform that functions on the cloud. The partnership connects the Hootsuite dashboard to its Bynder-provided digital assets, allowing social media marketers to get easy access to creative content without having to resize, re-upload, and download individual files.

The growth of cloud-based digital asset management is driven by the growing acceptance of advancing technologies like data analytics and artificial intelligence across industries. Artificial intelligence is used in digital asset management for creating tags for metadata by scanning the content. Digital asset management uses artificial intelligence for speech recognition, facial recognition, and retinal scan recognition.

Digital asset management creates huge data, that have to be stored. Therefore the demand for data storage is increasing with the growing digital asset management solutions. Machine learning and artificial intelligence have the ability to collect, monitor, process and evaluate the data and transfer it to various clouds. Major companies in this field are Bynder, MediaBeacon, and Cognizant. These companies are fueling the market to expand vigorously.

Market Growth

The digital asset management market is growing due to companies in the market are innovating new strategies to expand the market. Major companies are focusing on offering simple plus efficient user experiences by introducing innovative and technologically advanced solutions. Many users are looking towards digital asset management to ease their working process and resolve issues. For example, Adobe announced their new software ‘streamlined Adobe experience manager’ which allows users a simple and elegant user experience for the Adobe experience cloud.

Regional Analysis

Asia-Pacific leads the market with the largest market share for digital asset management at 34.8%. Significant market opportunities and strong companies are driving the growth of digital asset management in the Asia Pacific region. Emerging markets such as China and India are also adopting at a faster pace than North America and Europe. Asia Pacific is the largest buyer of data asset management solutions due to the presence of a large number of manufacturing industries and large enterprises in the region.

North America is anticipated to see lucrative market growth in the global digital asset management market, during the forecast period of 2023 to 2032. This is due to the acceptance that digital asset management is growing in the United States and Canada mainly due to investments in cloud adoption, innovation activities, and growth in IoT devices. The increasing digitization of various end-user industries in the country also leads to significant data generation, expected to drive market growth throughout the forecast period.

Competitive Landscape

Key players in the market are focusing on different strategies to expand their businesses in overseas markets. Several digital asset management companies are focusing on expanding their existing operations and R&D facilities. Additionally, companies in the DAM market are developing new products and portfolio expansion strategies through investments, mergers, and acquisitions. Some of the major players in the market include Oracle Corporation, IBM Corporation, Webdam Inc, Canto Inc., MediaBeacon Inc., Cognizant Technology Solutions Corp., Celartem Inc., Widen Enterprises Inc., Adobe Systems Incorporated, Huobi Asset Management, and Other Key Players.

Have Queries? Speak to an expert, or To Download/Request a Sample, Click here.

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 4.3 billion |

| Market Size (2032) | USD 15.2 Billion |

| CAGR (from 2023 to 2032) | 13.8% |

| Asia Pacific Revenue Share | 34.8% |

| Base Year | 2022 |

| Forecast Year | 2023-2032 |

Market Drivers

Evolving trend of digitization and increasing acceptance of cloud-based services across the globe are the key factors driving the growth of the market. As the demand for workflow partnerships and automation is growing, more and more companies are adopting digital asset management solutions to maintain operational transparency, enhance digital content and reduce the total cost of ownership. Also, the increasing interest of organizations in digital marketing is driving the growth of the market. As consumers spend more and more time on various social media platforms, businesses are using these solutions to reach the masses, improve customer engagement, and integrate analytics tools to understand consumer behavior patterns.

Market Restraints

The lack of awareness for accepting digital asset management software by small and medium enterprises in developing countries can hamper the growth of the global market during the forecast period. Also, high initial investments and a lack of skilled professionals are estimated to negative impact on market growth. In addition, the lack of a skilled workforce also has a negative impact on market growth. Digital asset management solutions are expensive depending on capacity and features. The difference between mid-range and high-end devices is usually a high degree of upgradation with the creative and production process. A mid-range solution can back the DAM by Adobe PhotoShop. However, high-end systems can also offer state-of-the-art video editing tools such as tools that are used in film production studios.

Market Opportunities

The digital asset management market is anticipated to grow throughout the forecast period by introducing advanced technologies like the internet of things(IoT) and artificial intelligence(AI). Digital asset management is also boosted due to growing applications in healthcare, manufacturing, and IT industries in several emerging economies such as Brazil, India, South Africa, and China. The rapidly increasing geriatric population, rising per capita incomes, high adoption of mobiles, advanced technologies, and spiking awareness among enterprises are driving the need for enhancing the healthcare industries in these nations. Therefore, the governments in these economies are increasing their investments aimed at improving IT infrastructure. Owing to the high number of applications of digital asset management in IT industries the rising investment in this industry is slated to offer growth opportunities in the market.

Grow your profit margin with Market.us – Purchase This Premium Digital Asset Management Market Report at https://market.us/purchase-report/?report_id=67757

Report Segmentation of the Digital Asset Management Market

Component Insight

The digital asset management market is divided into solutions and services, based on component type. In component type, the solutions segment leads the digital asset management market by accounting for a major revenue share in the market. As More and more apps and smart devices need to be made available through DAM so companies can create personalized app practices for customers, internal users, and partners. Organizations in all industries need a strong DAM management software solution to measure the feat of DAM-centric businesses. The services segment is further classified into consulting, implementation & Integration, and Others. Digital asset management consulting services refer to the successful implementation of a new learning management system of the current DAM to improve experience and engagement.

Deployment Insight

Based on deployment digital asset management is classified into on-premise and cloud deployment. In deployment, the on-premise segment dominated the market by covering a major part of the market share in 2022. On-premises deployments have features like better integration, longer deployment, and customization. Training and development departments in all organizations are rapidly adopting on-premises deployment. The majority of companies are adopting technology-enabled learning, which allows employees to record, display, and create innovative ideas in the company. Companies adopting mobile learning solutions have increased productivity, as well as employee creativity with loyalty.

Business Function Insight

The business functions of digital asset management are divided into human resources, sales and marketing, information technology, and other business functions. Out of all the business functions, the information technology business function rules the market in 2022. Digital asset management is used in IT to help organizations store, find, organize, and share their entire content library from one place to another. DAM can use to assets team members and clients. HR teams can utilize DAM to store employee files, such as resumes, videos, and photos, making it easy to track employee data and systematically share them with others. A DAM system is used in businesses to collaborate, organize, distribute, and securely store the digital files that make a digital asset library. It contains features such as permission control, asset performance analytics, and right management.

End-Use Industry Insight

End-use industries of digital asset management are classified into healthcare, education, manufacturing, IT & telecommunication, BFSI, government and public sector, travel and hospitality, retail and e-commerce, and other sectors. From these sectors, the IT and telecommunications industry is anticipated to grow significantly over the forecast period of 2023 to 2032. Digital asset management is majorly used in the IT and telecommunications sectors. As a result, it becomes a critical factor for companies to manage their digital asset effectively. Similarly, BFSI is expected to become one of the most important industries to adopt DAM solutions, after IT and Telecom. Improving employee engagement and improving the value chain have become important aspects of the healthcare industry.

Recent Development of the Digital Asset Management Market

- In May 2021, Bynder introduced the SAP Commerce Cloud connector. It allows companies to deliver relevant and timely product media to power engaging and customized e-commerce experiences.

- In February 2021, Esko and FADEL came together for the association of cloud-based digital rights management software, rights cloud from FADEL, and digital asset management solution from MediaBeacon.

For more insights on the historical and Forecast Digital Asset Management Market data from 2016 to 2032 – download a sample report at https://market.us/report/digital-asset-management-dam-software-market/#requestSample

Market Segmentation

By Component

- Solution

- Services

- Consulting

- Integration & Implementation

- Others

By Deployment

- On-Premises

- Cloud

By Business Function

- Human Resources

- Information Technology

- Sales & Marketing

End-Use Industry

- IT & Telecommunication

- BFSI

- Government & Public Sector

- Healthcare

- Education

- Manufacturing

- Travel & Hospitality

- Retail & E-Commerce

- Other end-use industries

By Geography

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Key Players:

- IBM Corporation

- Webdam Inc.

- Cognizant Technology Solutions Corp

- Canto Inc.

- MediaBeacon Inc.

- Oracle Corporation

- Celartem Inc.

- Adobe Systems Incorporated

- Huobi Asset Management

- Widen Enterprises Inc.

- Hootsuite Inc.

- Canto Inc.

- Other Key Players

Browse More Related Reports:

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn | Facebook | Twitter

Our Blog:

Artificial Intelligence

Terra Drone, Unifly, and Aloft Launch UTM Development for AAM Targeting Global Markets

TOKYO, April 25, 2024 /PRNewswire/ — Terra Drone Corporation, a leading drone and Advanced Air Mobility (AAM) technology provider headquartered in Japan, announced today the launch of joint development with its Group companies Unifly NV (“Unifly”) and Aloft Technologies Inc. (“Aloft”) focused on UAS Traffic Management (UTM) for AAMs targeting global markets. Terra Drone has been making strides in its pioneering UTM business via strategic investments in Unifly, a leading UTM technology provider based in Belgium, and Aloft, which has the top UTM market share in the U.S. This collaboration marks the world’s first-ever joint UTM development for AAMs by multiple companies with extensive track records in UTM implementation and operation.

The three companies pursue joint UTM development to capitalize on the rapid global progress in electric vertical take-off and landing aircrafts (eVTOLs), set to revolutionize transportation. Morgan Stanley forecasts the Urban Air Mobility (UAM) market to reach $1 trillion by 2040 and $9 trillion by 2050 (1), with eVTOLs gaining global recognition through test flights and prototype showcases.

The companies proudly announce initiatives to enhance their existing UTM platforms in anticipation of the surge in eVTOL aircraft and drone activities. The shared vision for the UTM platform is to enable safe and efficient flight operations for eVTOLs and drones in the foreseeable future.

Recognizing the evolving needs of the AAM industry, they are dedicated to extending their platform by incorporating crucial additional functions. These enhancements, designed with automation at their core, aim to streamline operational efficiencies and pave the way for the integration of their increasingly automated UTM technology into the design and operational framework of AAMs. Through these efforts, they aim to set new standards in UTM and to facilitate the seamless integration of eVTOLs and drones into the national airspace, bolstering the potential for the AAM industry.

Through this initiative, they aim to build a global UTM infrastructure that kickstarts the AAM industry worldwide, creating a cohesive ecosystem that supports AAM growth and addresses broader challenges of urban mobility, sustainability, and air traffic safety.

Notes to Editor:

Research by Morgan Stanley in a report titled “eVTOL/Urban Air Mobility TAM Update: A Slow Take-Off, But Sky’s the Limit” https://advisor.morganstanley.com/the-busot-group/documents/field/b/bu/busot-group/Electric%20Vehicles.pdf]

Photo – https://mma.prnewswire.com/media/2396553/Terra_Drone.jpgLogo – https://mma.prnewswire.com/media/2186129/Terra_Drone_Logo.jpg

View original content:https://www.prnewswire.co.uk/news-releases/terra-drone-unifly-and-aloft-launch-utm-development-for-aam-targeting-global-markets-302126451.html

Artificial Intelligence

IBM to Acquire HashiCorp, Inc. Creating a Comprehensive End-to-End Hybrid Cloud Platform

$6.4 billion acquisition adds suite of leading hybrid and multi-cloud lifecycle management products to help clients grappling with today’s AI-driven application growth and complexity

HashiCorp’s capabilities to drive significant synergies across multiple strategic growth areas for IBM, including Red Hat, watsonx, data security, IT automation and Consulting

As a part of IBM, HashiCorp is expected to accelerate innovation and enhance its go-to-market, growth and monetization initiatives

Transaction expected to be accretive to Adjusted EBITDA within the first full year, post close, and free cash flow in year two

ARMONK, N.Y. and SAN FRANCISCO, April 24, 2024 /PRNewswire/ — IBM (NYSE: IBM) and HashiCorp Inc. (NASDAQ: HCP), a leading multi-cloud infrastructure automation company, today announced they have entered into a definitive agreement under which IBM will acquire HashiCorp for $35 per share in cash, representing an enterprise value of $6.4 billion. HashiCorp’s suite of products provides enterprises with extensive Infrastructure Lifecycle Management and Security Lifecycle Management capabilities to enable organizations to automate their hybrid and multi-cloud environments. Today’s announcement is a continuation of IBM’s deep focus and investment in hybrid cloud and AI, the two most transformational technologies for clients today.

“Enterprise clients are wrestling with an unprecedented expansion in infrastructure and applications across public and private clouds, as well as on-prem environments. The global excitement surrounding generative AI has exacerbated these challenges and CIOs and developers are up against dramatic complexity in their tech strategies,” said Arvind Krishna, IBM chairman and chief executive officer. “HashiCorp has a proven track record of enabling clients to manage the complexity of today’s infrastructure and application sprawl. Combining IBM’s portfolio and expertise with HashiCorp’s capabilities and talent will create a comprehensive hybrid cloud platform designed for the AI era.”

The rise of cloud-native workloads and associated applications is driving a radical expansion in the number of cloud workloads enterprises are managing. In addition, generative AI deployment continues to grow alongside traditional workloads. As a result, developers are working with increasingly heterogeneous, dynamic, and complex infrastructure strategies. This represents a massive challenge for technology professionals.

HashiCorp’s capabilities enable enterprises to use automation to deliver lifecycle management for infrastructure and security, providing a system of record for the critical workflows needed for hybrid and multi-cloud environments. HashiCorp’s Terraform is the industry standard for infrastructure provisioning in these environments. HashiCorp’s offerings help clients take a cloud-agnostic, and highly interoperable approach to multi-cloud management, and complement IBM’s commitment to industry collaboration (including deep and expanding partnerships with hyperscale cloud service providers), developer communities, and open-source hybrid cloud and AI innovation.

“Our strategy at its core is about enabling companies to innovate in the cloud, while providing a consistent approach to managing cloud at scale. The need for effective management and automation is critical with the rise of multi-cloud and hybrid cloud, which is being accelerated by today’s AI revolution,” said Armon Dadgar, HashiCorp co-founder and chief technology officer. “I’m incredibly excited by today’s news and to be joining IBM to accelerate HashiCorp’s mission and expand access to our products to an even broader set of developers and enterprises.”

“Today is an exciting day for our dedicated teams across the world as well as the developer communities we serve,” said Dave McJannet, HashiCorp chief executive officer. “IBM’s leadership in hybrid cloud along with its rich history of innovation, make it the ideal home for HashiCorp as we enter the next phase of our growth journey. I’m proud of the work we’ve done as a standalone company, I am excited to be able to help our customers further, and I look forward to the future of HashiCorp as part of IBM.”

Transaction Rationale

Strong Strategic Fit – The acquisition of HashiCorp by IBM creates a comprehensive end-to-end hybrid cloud platform built for AI-driven complexity. The combination of each company’s portfolio and talent will deliver clients extensive application, infrastructure and security lifecycle management capabilitiesAccelerates growth in key focus areas – Upon close, HashiCorp is expected to drive significant synergies for IBM, including across multiple strategic growth areas like Red Hat, watsonx, data security, IT automation and Consulting. For example, the powerful combination of Red Hat’s Ansible Automation Platform’s configuration management and Terraform’s automation will simplify provisioning and configuration of applications across hybrid cloud environments. The two companies also anticipate an acceleration of HashiCorp’s growth initiatives by leveraging IBM’s world-class go-to-market strategy, scale, and reach, operating in more than 175 countries across the globeExpands Total Addressable Market (TAM) – The acquisition will create the opportunity to deliver more comprehensive hybrid and multi-cloud offerings to enterprise clients. HashiCorp’s offerings, combined with IBM and Red Hat, will give clients a platform to automate the deployment and orchestration of workloads across evolving infrastructure including hyperscale cloud service providers, private clouds and on-prem environments. This will enhance IBM’s ability to address the total cloud opportunity, which according to IDC had a TAM of $1.1 trillion in 2023, with a compound annual growth rate in the high teens through 2027.1Attractive Financial Opportunity – The transaction will accelerate IBM’s growth profile over time driven by go-to-market and product synergies. This growth combined with operating efficiencies, is expected to achieve substantial near-term margin expansion for the acquired business. It is anticipated that the transaction will be accretive to Adjusted EBITDA within the first full year, post close, and free cash flow in year two.HashiCorp boasts a roster of more than 4,400 clients, including Bloomberg, Comcast, Deutsche Bank, GitHub, J.P Morgan Chase, Starbucks and Vodafone. HashiCorp’s offerings have widescale adoption in the developer community and are used by 85% of the Fortune 500. Their community products across infrastructure and security were downloaded more than 500 million times in HashiCorp’s FY2024 and include:

Terraform – provides organizations with a single workflow to provision their cloud, private datacenter, and SaaS infrastructure and continuously manage infrastructure throughout its lifecycleVault – provides organizations with identity-based security to automatically authenticate and authorize access to secrets and other sensitive dataAdditional products – Boundary for secure remote access; Consul for service-based networking; Nomad for workload orchestration; Packer for building and managing images as code; and Waypoint internal developer platformTransaction Details

Under the terms of the agreement, IBM will acquire HashiCorp for $35 per share in cash, or $6.4 billion enterprise value, net of cash. HashiCorp will be acquired with available cash on hand.

The boards of directors of IBM and HashiCorp have both approved the transaction. The acquisition is subject to approval by HashiCorp shareholders, regulatory approvals and other customary closing conditions.

The Company’s largest shareholders and investors, who collectively hold approximately 43% of the voting power of HashiCorp’s outstanding common stock, entered into a voting agreement with IBM pursuant to which each has agreed to vote all of their common shares in favor of the transaction and against any alternative transactions.

The transaction is expected to close by the end of 2024.

____________________1 The total cloud opportunity is the sum of the cloud-directed spends across Hardware, IT services and SW for Private and Public cloud implementation, sourced from IDC’s Worldwide Black Book Live Edition, March 2024 (V1 2024)

Conference Call Details

IBM’s regular quarterly earnings conference call is scheduled to begin at 5:00 p.m. ET, today. The Webcast may be accessed here. Presentation charts will be available shortly before the Webcast.

About IBM

IBM is a leading provider of global hybrid cloud and AI, and consulting expertise. We help clients in more than 175 countries capitalize on insights from their data, streamline business processes, reduce costs and gain the competitive edge in their industries. Thousands of government and corporate entities in critical infrastructure areas such as financial services, telecommunications and healthcare rely on IBM’s hybrid cloud platform and Red Hat OpenShift to affect their digital transformations quickly, efficiently and securely. IBM’s breakthrough innovations in AI, quantum computing, industry-specific cloud solutions and consulting deliver open and flexible options to our clients. All of this is backed by IBM’s legendary commitment to trust, transparency, responsibility, inclusivity and service. Visit www.ibm.com for more information.

About HashiCorp

HashiCorp is The Infrastructure Cloud™ company, helping organizations automate multi-cloud and hybrid environments with Infrastructure Lifecycle Management and Security Lifecycle Management. HashiCorp offers The Infrastructure Cloud on the HashiCorp Cloud Platform (HCP) for managed cloud services, as well as self-hosted enterprise offerings and community source-available products. The company is headquartered in San Francisco, California. For more information, visit HashiCorp.com.

Press Contacts:

IBM:Tim Davidson, [email protected]

HashiCorp:Matthew Sherman / Jed Repko / Haley Salas / Joycelyn BarnettJoele Frank, Wilkinson Brimmer Katcher212-355-4449

Additional Information and Where to Find It

HashiCorp, Inc. (“HashiCorp”), the members of HashiCorp’s board of directors and certain of HashiCorp’s executive officers are participants in the solicitation of proxies from stockholders in connection with the pending acquisition of HashiCorp (the “Transaction”). HashiCorp plans to file a proxy statement (the “Transaction Proxy Statement”) with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies to approve the Transaction. David McJannet, Armon Dadgar, Susan St. Ledger, Todd Ford, David Henshall, Glenn Solomon and Sigal Zarmi, all of whom are members of HashiCorp’s board of directors, and Navam Welihinda, HashiCorp’s chief financial officer, are participants in HashiCorp’s solicitation. Information regarding such participants, including their direct or indirect interests, by security holdings or otherwise, will be included in the Transaction Proxy Statement and other relevant documents to be filed with the SEC in connection with the Transaction. Additional information about such participants is available under the captions “Board of Directors and Corporate Governance,” “Executive Officers” and “Security Ownership of Certain Beneficial Owners and Management” in HashiCorp’s definitive proxy statement in connection with its 2023 Annual Meeting of Stockholders (the “2023 Proxy Statement”), which was filed with the SEC on May 17, 2023 (and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1720671/000114036123025250/ny20008192x1_def14a.htm). To the extent that holdings of HashiCorp’s securities have changed since the amounts printed in the 2023 Proxy Statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC (which are available at https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001720671&type=&dateb=&owner=only&count=40&search_text=). Information regarding HashiCorp’s transactions with related persons is set forth under the caption “Related Person Transactions” in the 2023 Proxy Statement. Certain illustrative information regarding the payments to that may be owed, and the circumstances in which they may be owed, to HashiCorp’s named executive officers in a change of control of HashiCorp is set forth under the caption “Executive Compensation—Potential Payments upon Termination or Change in Control” in the 2023 Proxy Statement. With respect to Ms. St. Ledger, certain of such illustrative information is contained in the Current Report on Form 8-K filed with the SEC on June 7, 2023 (and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1720671/000162828023021270/hcp-20230607.htm). Promptly after filing the definitive Transaction Proxy Statement with the SEC, HashiCorp will mail the definitive Transaction Proxy Statement and a WHITE proxy card to each stockholder entitled to vote at the special meeting to consider the Transaction. STOCKHOLDERS ARE URGED TO READ THE TRANSACTION PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT HASHICORP WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the preliminary and definitive versions of the Transaction Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by HashiCorp with the SEC in connection with the Transaction at the SEC’s website (http://www.sec.gov). Copies of HashiCorp’s definitive Transaction Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by HashiCorp with the SEC in connection with the Transaction will also be available, free of charge, at HashiCorp’s investor relations website (https://ir.hashicorp.com/), or by emailing HashiCorp’s investor relations department ([email protected]).

Forward-Looking Statements

Certain statements contained in this communication may be characterized as forward-looking under the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially.

Statements in this communication regarding IBM and HashiCorp that are forward-looking may include statements regarding: (i) the Transaction; (ii) the expected timing of the closing of the Transaction; (iii) considerations taken into account in approving and entering into the Transaction; (iv) the anticipated benefits to, or impact of, the Transaction on IBM’s and HashiCorp’s businesses; and (v) expectations for IBM and HashiCorp following the closing of the Transaction. There can be no assurance that the Transaction will be consummated.

Risks and uncertainties that could cause actual results to differ materially from those indicated in the forward-looking statements, in addition to those identified above, include: (i) the possibility that the conditions to the closing of the Transaction are not satisfied, including the risk that required approvals from HashiCorp’s stockholders for the Transaction or required regulatory approvals to consummate the Transaction are not obtained, on a timely basis or at all; (ii) the occurrence of any event, change or other circumstance that could give rise to a right to terminate the Transaction, including in circumstances requiring HashiCorp to pay a termination fee; (iii) possible disruption related to the Transaction to IBM’s and HashiCorp’s current plans, operations and business relationships, including through the loss of customers and employees; (iv) the amount of the costs, fees, expenses and other charges incurred by IBM and HashiCorp related to the Transaction; (v) the risk that IBM’s or HashiCorp’s stock price may fluctuate during the pendency of the Transaction and may decline if the Transaction is not completed; (vi) the diversion of IBM and HashiCorp management’s time and attention from ongoing business operations and opportunities; (vii) the response of competitors and other market participants to the Transaction; (viii) potential litigation relating to the Transaction; (ix) uncertainty as to timing of completion of the Transaction and the ability of each party to consummate the Transaction; and (x) other risks and uncertainties detailed in the periodic reports that IBM and HashiCorp filed with the SEC, including IBM’s and HashiCorp’s respective Annual Reports on Form 10-K. All forward-looking statements in this communication are based on information available to IBM and HashiCorp as of the date of this communication, and, except as required by law, IBM and HashiCorp do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

Logo – https://mma.prnewswire.com/media/2319830/IBM_LOGO_1.jpg

View original content:https://www.prnewswire.co.uk/news-releases/ibm-to-acquire-hashicorp-inc-creating-a-comprehensive-end-to-end-hybrid-cloud-platform-302126677.html

Artificial Intelligence

Businessabc.net, part of Ztudium group partners with IEBF to offer GenerativeAI tools for SMEs, Adds Dilip Pungliya to Leadership

LONDON and NEW DELHI, April 24, 2024 /PRNewswire/ — Businessabc.net part of ztudium group partners with Indo-European Business Forum IEBF and signed an MOU to collaborate in building tech AI-powered tools and trade corridors and technological solutions for businesses in India, UK, and Europe.

Businessabc.net is a global business abc AI, digital certification search engine, and directory marketplace that offers a fresh approach to business insights, and analytics and makes it accessible to every company, and employee, empowering knowledge-sharing and strategic insights across every level for businesses worldwide. Businessabc offers a digital hub marketplace to empower SMEs and businesses of all types with B2B, B2C, and AI-powered tools, that give them access to strategies, and insights and connect them with chambers of commerce, trade corridors, digital supply chains, provenance tools, and multi-store e-commerce solutions. The Indo-European Business Forum – IEBF is an independent, impartial organisation promoting two-way flows of trade, and investment in India, the UK, and EU member countries.

Businessabc.net owned by ztudium announces this strategic partnership with the IEBF and announces Dilip Pungliya as a new partner and Board Member to lead these endeavours. In this role, Mr. Pungliya, a tech, business, and data scientist executive will bring his extensive expertise in business strategy and digital transformation to lead key initiatives within the organisation.

The growth of Generative AI among Small and Medium Enterprises (SMEs) worldwide has been steadily gaining momentum, and in India, the UK, and Europe a burgeoning tech ecosystem is growing awareness of the transformative potential of artificial intelligence.

IEBF and Businessabc.net join forces to expand the platform with new indexes powered by Generative AI to enhance efficiency, streamline operations, and give companies a competitive edge in the market. Factors such as the availability of cost-effective AI solutions, the skilled workforce, and a global need to push towards digitalisation have contributed to the adoption of Generative AI technologies. GenAI tools and tech solutions are critical to unlocking new value for businesses and becoming the most important tools for organisations of all sizes. AI revolution through platforms such as businessabc.net semantic and GenAI search, indexes, and chatbots, can solve business problems and offer leaders integrated solutions for their growth.

IEBF has been collaborating with Governments in India, UK, and Europe,. Their contribution includes events in the UK House of Lords, Indian governmental organisations, and research and education initiatives for businesses. Created by Mr. Vijay Goel and Mr. Sunil Kumar Gupta the founders, responsibles for the organisation said about this: “We are excited to work and enhance business solutions between IEBF and Businessabc.net, part of Ztudium group. All businesses need to be aware, educated, and prepared for this new AI and digital growth tools world. Data from India’s Ministry of Electronics and Information Technology (MeitY) reports that GenAI is expected to add USD 450–500 billion to India’s GDP by 2025 – 10% of the country’s USD 5 trillion GDP target. We expect to work together to empower businesses in India, the UK, and Europe joining forces with Businessabc.net to organise strategic trade corridors, events, and Indexes.”

Dinis Guarda, Founder of Ztudium / Businessabc.net, a business top thought leader, author, and Youtuber said about the partnership: “We are thrilled to work with IEBF to expand the businessabc.net solutions to India, UK, and Europe businesses and welcome Dilip Punglyia to support, lead this partnership and Ztudium group. Together we will offer cutting-edge simple tools that use genAI in business and finance. In the financial sector alone GenAI is expected to increase global gross domestic product (GDP) by 7%—nearly $7 trillion—and boost productivity growth by 1.5%, according to Goldman Sachs Research.”

Dilip Pungliya, a seasoned tech, digital, and business strategy leader with more than twenty five years of experience creating data-driven solutions will be at the forefront of this partnership. Mr. Dilip Pungliya said about this: “I’m thrilled to join businessabc.net and Ztudium leadership team and contribute to the growth of the partnership with the IEBF and its holistic company’s mission of driving innovation and digital transformation through cutting-edge technologies like AI, fintech, Web 3.0, Metaverse, and Blockchain. This partnership will allow us to create a digital ID, new AI data-driven generative tools, and scale growth for businesses in India, UK, and Europe, and Dilip’s wealth of experience and strategic vision will be invaluable as we continue to drive innovation and empower businesses with transformative technologies.”

About the Indo-European Business Forum

IEBF is an independent, impartial body actively promoting two-way flows of trade, and investment in India and EU member countries. Indo European Business Forum is an open forum comprising like-minded people who believe that “India can offer strong and sustained business opportunities for European Union countries”. IEBF is patronised by leading personalities from both India and the EU having excellence in the fields of business, finance, real estate, and art, to name a few. Our advisory board consists of people who are determined to create a progressive world.

About the Businessabc.net,

Founded in August 2011 by Dinis Guarda, who was joined by Sonesh Sira as board and partner some years after businessabc.net part of Ztudium group has been creating Digital Transformation, and AI tools and being recognised as one of the top global thought leaders organisations by organisations like Thinkers360.com. The company has been working and advising Fortune 500 companies and governments and offers technology products and platforms. Some of its offers are citiesabc.com, fashionsabc.com, sportsabc.org. It also manages a media division with intelligenthq.com, tradersdna.com, hedgethink.com, and services that integrate a wide range of 4IR, AI, 3D, web 3.0, and blockchain technologies solutions such as Metaverseabc. tech, MStores.shopping, iDNA.technology, and AI.DNA. The platform unveiled recently its Top 10,000 Public Companies Market Cap Index, which lists tech giants like Apple, Microsoft, Google, Alphabet, Nvidia, and Meta, and LVMH, IBM, and JPMorgan Chase & Co., from other industries at the top.

About Ztudium: The maker of 4IR, AI, Web 3.0, and Smart Cities technologies

Ztudium is a UK-based global maker of leading proprietary intellectual property and technologies that integrate Fourth Industrial Revolution (4IR) technologies. The company creates technology products, platforms, media, and services that integrate fintech, smart cities, Web 3.0, AI, Metaverse, and Blockchain. Ztudium collaborates with multiple governments, organisations, educational institutions, and business networks worldwide.

For media inquiries, please contact:

Media Contact Name: Manan KothariEmail Address: [email protected] Number: +44 7833881659

Company Name: Businessabc / ZtudiumCompany Address: 85, Great portland street, London W1W7LTWebsite URL: www.businessabc.net, www.ztudium.com

View original content:https://www.prnewswire.co.uk/news-releases/businessabcnet-part-of-ztudium-group-partners-with-iebf-to-offer-generativeai-tools-for-smes-adds-dilip-pungliya-to-leadership-302126571.html

-

Uncategorized5 days ago

Uncategorized5 days agoGenerative AI gold rush drives IT spending — with payoff in question

-

Uncategorized5 days ago

Uncategorized5 days agoDo underwriters trust artificial intelligence?

-

Uncategorized5 days ago

Uncategorized5 days agoHans Jonas on Responsibility in the Age of Artificial Intelligence

-

Uncategorized5 days ago

Uncategorized5 days agoMeta AI Assistant Adds Website, Expands Beyond US

-

Artificial Intelligence5 days ago

Artificial Intelligence5 days agoFree Your Hands, QIDI Vida Smart AR Glasses Lead the Way in New Sports Experience.

-

Uncategorized5 days ago

Uncategorized5 days agoCan artificial intelligence reduce vehicle time to market?

-

Uncategorized5 days ago

Uncategorized5 days agoThe Ottawa Hospital doctors to try AI for patient notes

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days agoAurionpro Solutions acquires Arya.ai, to power next generation Enterprise AI platforms for Financial Institutions