Artificial Intelligence

Alternative Financing Market to exceed $40 Bn by 2032, Says Graphical Research Powered by GMI

<!– Name:DistributionId Value:8845444 –> <!– Name:EnableQuoteCarouselOnPnr Value:False –> <!– Name:IcbCode Value:2790 –> <!– Name:CustomerId Value:1218110 –> <!– Name:HasMediaSnippet Value:false –> <!– Name:AnalyticsTrackingId Value:0fd6f68e-6ba4-4255-b7c3-0aaf72f43b90 –>

Selbyville, Delaware, May 24, 2023 (GLOBE NEWSWIRE) —

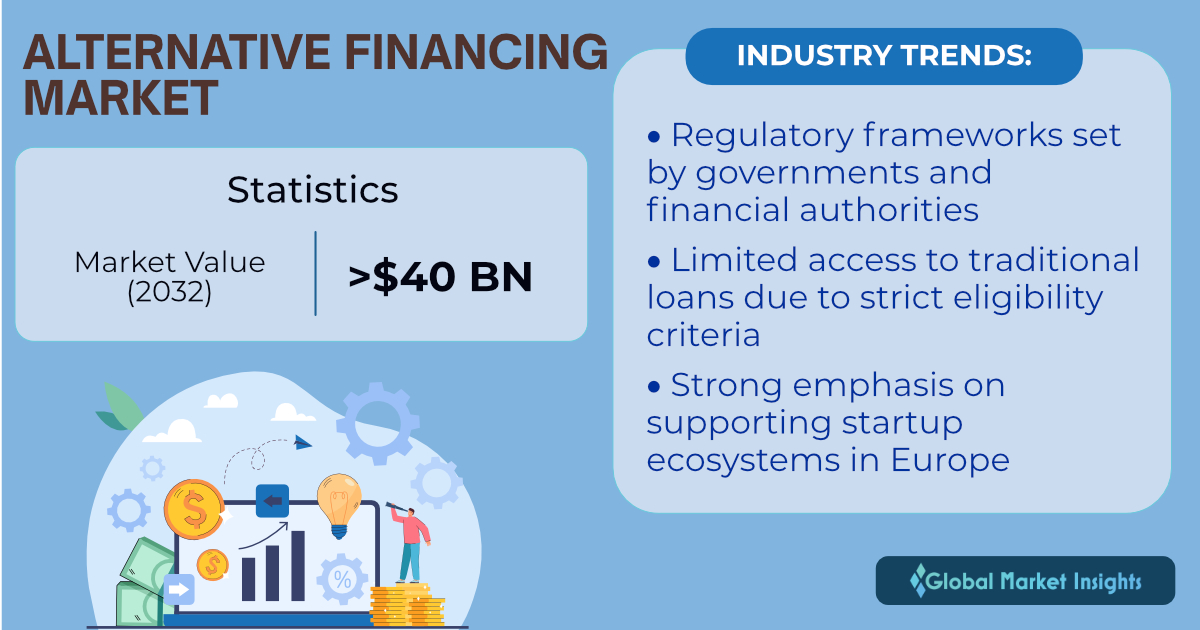

The alternative financing market valuation is expected to surpass USD 40 billion by 2032, as reported in a research study by Global Market Insights Inc.

Rapid advancements in technology, particularly in fintech, have revolutionized the financial industry. Alternative financing platforms leverage technology to provide efficient and user-friendly services, enabling borrowers and investors to connect directly without intermediaries. In addition, the popularity of online platforms and mobile apps that allow borrowers and investors to participate in alternative financing transactions from anywhere and anytime has boosted the business dynamics. Regulatory frameworks set by governments and financial authorities are also driving industry trends.

Request for a sample of this research report @ https://www.gminsights.com/request-sample/detail/5670

The alternative financing market from the crowdfunding segment will depict a remarkable CAGR from 2023 to 2032, owing to the growth of the internet and digital platforms. Crowdfunding platforms offer these technologies to create online marketplaces, connecting individuals or businesses seeking funding with potential investors. Moreover, the capability to provide a wide range of investment opportunities across various sectors and stages of business development is set to fuel product adoption.

The alternative financing market from the individual financing segment is likely to account for a prominent industry share by 2032, as a result of limited access to traditional loans due to strict eligibility criteria and a preference for faster processing times and more flexible terms. The peer-to-peer approach eliminates the need for traditional financial intermediaries, reduces costs, and allows borrowers to access loans quickly.

Europe alternative financing market will grow considerably through 2032. European regulatory bodies introduce measures to support and promote alternative financing options, such as the Capital Markets Union (CMU) initiative, which aims to harmonize regulations across EU member states and make it easier for businesses to access alternative financing sources. Furthermore, a strong regional focus on fostering innovation and supporting startup ecosystems will benefit the product outlook and has effectively increased the awareness of benefits and risks associated with alternative financing.

Make an inquiry for purchasing this report @ https://www.gminsights.com/inquiry-before-buying/5670

Prominent participants operating across the alternative financing industry are Credoc, Borrowers First, Finastra, GoFundMe, Funding Circle, Kickstarter, LendingClub, Kiva Microfunds, Upstart Network, Inc., Prosper Funding LLC, LendingCrowd, RateSetter, Quicken Loans (Rocket Mortgage, LLC), Sofi, and Zopa. They are adopting product diversification and business expansion tactics to stay ahead in the competitive scenario.

Alternative financing market news

- In January 2023, RateSetter’s division Metro Bank, entered the digital car loan market in the UK. With this, the company aims to use RateSetter’s peer-to-peer technology for its broker partners. The paperless application allows eligible borrowers to access their car on the same day. The companies aim to expand their presence in other parts of the world.

- In July 2022, Finastra, a financial services firm, introduced an embedded ‘alternative’ BNPL product that was intended to blend traditional regulated lending solutions with POS finance.

Partial chapters of report table of contents (TOC):

Chapter 2 Executive Summary

2.1 Alternative financing market 360º synopsis, 2018 – 2032

2.2 Business trends

2.2.1 Total Addressable Market (TAM)

2.3 Regional trends

2.4 Type trends

2.5 End use trends

Chapter 3 Alternative Financing Market Insights

3.1 Impact on COVID-19

3.2 Russia- Ukraine war impact

3.3 Industry ecosystem analysis

3.4 Vendor matrix

3.5 Profit margin analysis

3.6 Technology & innovation landscape

3.6.1 Blockchain

3.6.2 Artificial intelligence (AI)

3.7 Patent analysis

3.8 Key news and initiatives

3.9 Regulatory landscape

3.10 Impact forces

3.10.1 Growth drivers

3.10.1.1 Rising adoption of IOT and blockchain-based alternative financing platforms

3.10.1.2 Surge adoption of alternative finance

3.10.1.3 Lower operating cost of alternative financing

3.10.1.4 Increase in technology driven lenders

3.10.2 Industry pitfalls & challenges

3.10.2.1 Lack of awareness and understanding

3.11 Growth potential analysis

3.12 Porter’s analysis

3.13 PESTEL analysis

Browse our Reports Store – GMIPulse @ https://www.gminsights.com/gmipulse

Browse Related Reports:

Financial Analytics Market – By Component (Solution, Service), By Deployment Model (On-premise, Cloud), By Organization Size (SME, Large Enterprises), By Application, By End-use & Forecast, 2022-2030

https://www.gminsights.com/industry-analysis/financial-analytics-market

Wealth Management Platform Market Size By Advisory Mode (Human Advisory, Robo Advisory, Hybrid), By Deployment Model (On-premise, Cloud), Application, End-use & Global Forecast, 2023 – 2032

https://www.gminsights.com/industry-analysis/wealth-management-software-market

About Global Market Insights Inc.

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.

Artificial Intelligence

Timekettle Announces Major Software Update, Launching AI Translation Lab

SHENZHEN, China, April 18, 2024 /PRNewswire/ — Timekettle, a fast-growing cross-language communication solutions innovator, has announced a significant software update with the launch of the AI Translation Lab, which will serve as a new platform to rapidly introduce cutting-edge technological features while gathering immediate user feedback to avoid releasing underdeveloped functionalities.

The AI Translation Lab represents a major advancement in rendering digital communication more personal, accurate, and educational across various languages. It introduces a range of key features aimed at greatly enhancing the accuracy and fluidity of translations.

Understanding the importance of accurate translations for proper nouns and specialized terms in everyday conversations, the AI Translation Lab features the Custom Lexicon, which allows users to create their own terms linked to specific translations, ensuring precision every time. As users add more terms over time, they will notice increasingly accurate translations with these personalized glossaries.

In an effort to counteract the mechanical feel of conventional translation tools, the AI Translation Lab has enhanced its voice feature to incorporate options that emulate human-like tonality with subtle emotional nuances. Users now have the liberty to select between male and female voices, ensuring a more organic auditory experience without sacrificing efficiency.

Customized for individuals grappling with practical language obstacles such as immigrants or international business personnel, the AI Language Tutor harnesses sophisticated AI technology to facilitate interactive learning experiences, with a focus on enhancing fluency and pronunciation. By integrating the AI Language Tutor into their ecosystem, Timekettle is not merely dismantling communication barriers, but also equipping users with the requisite skills for real-world interactions.

At present, Timekettle’s AI Translation Lab supports Chinese, English, and Spanish languages. As part of its ongoing commitment to making the world more interconnected, Timekettle is dedicated to adding more languages in upcoming updates, aligning with its goal of creating a world where people can easily communicate in their native language.

In today’s globalized world, the technologies and devices provided by Timekettle are becoming essential not just for travelers but also for international businesses that need clear communication without the setbacks of delays or errors due to poor translations. The creation of the AI Translation Lab highlights Timekettle’s dedication to developing technologies that respond to what users actually want.

Opening a door for users to evolve from simply using the technologies and devices to actively contributing to shaping our future, Timekettle invites global users to explore its AI Translation Lab, discover the latest offerings, share feedback instantly, and join the brand in breaking down language barriers through innovative technology.

About Timekettle

Established in 2016, Timekettle is an industry-leading and award-winning provider of cross-language communication solutions. Headquartered in Shenzhen, China, Timekettle also operates a customer center in Los Angeles, United States. Its exceptional products have been recognized with numerous international accolades, including the CES Innovation Award, iF Design Award, and Japan Good Design Award.

For further information, please visit https://www.timekettle.co/

Photo – https://mma.prnewswire.com/media/2390773/Al_Translation_Lab.jpg

View original content:https://www.prnewswire.co.uk/news-releases/timekettle-announces-major-software-update-launching-ai-translation-lab-302120663.html

Artificial Intelligence

Clearwater Analytics Wins IFRS 9 Solution Provider of the Year for Second Consecutive Year

Insurance Asset Risk Awards Celebrate Clearwater’s Excellence in IFRS 9 Solutions

BOISE, Idaho, April 18, 2024 /PRNewswire/ — Clearwater Analytics (NYSE: CWAN), a leading provider of SaaS-based investment management, accounting, reporting, and analytics solutions, today announced that it has won the IFRS 9 Solution Provider of the Year award for the second consecutive year. This achievement underscores Clearwater’s expertise in navigating the complexities of financial reporting and simplifying meticulous processes for our clients.

The Insurance Asset Risk Awards annually recognize outstanding technology firms in the insurance asset management sector. Clearwater Analytics distinguished itself from the competition with its cloud-based SaaS platform and dedicated Client Services offering, which provides a robust foundation to assist clients with their IFRS 9 plan, or global equivalents such as PSAK 71. The solution itself simplifies and streamlines adherence to the financial reporting rules for businesses of all sizes.

“We’re truly honored by this award, which highlights our team’s deep understanding of IFRS 9 and our dedication to supporting our clients,” said Keith Viverito, Managing Director, EMEA and APAC at Clearwater Analytics. “The journey towards IFRS 9 proficiency has been difficult for many in the industry. While insurers have become more adept over the years, there remains a significant need for improvement in operational models to align with best practices today. Clearwater simplifies the financial reporting process, making it faster and more accurate in aligning with IFRS 9 requirements. Our ability to automate the Expected Credit Loss (ECL) allowances and provide comprehensive data management solutions is a testament to our investments in innovation and relentless focus on customer success.”

One of the main challenges facing businesses for IFRS 9 adherence is the impairment of financial instruments, particularly the ECL model. Firms continuously struggle with data availability and quality, estimation techniques, scenario analysis, documentation, auditability, and the ongoing monitoring and reassessment of financial instruments. Clearwater’s success in delivering sophisticated solutions that address these challenges head-on has been a major factor behind its industry-leading 60+ NPS score.

This award joins a growing list of industry accolades, including the InsuranceAsia News Excellence Award for Technology Provider of the Year, the Chartis RiskTech Buyside 50 spot for Investment Lifecycle – Insurance/ Pension Funds, and the Captive Review Award for Software Solution of the Year. Each honor reaffirms Clearwater’s commitment to enhancing data quality and operational efficiency for clients around the globe.

Talk to an expert today to learn more about how Clearwater Analytics elevates financial operations and IFRS 9 compliance strategy.

About Clearwater Analytics

Clearwater Analytics (NYSE: CWAN), a global, industry-leading SaaS solution, automates the entire investment lifecycle. With a single instance, multi-tenant architecture, Clearwater offers award-winning investment portfolio planning, performance reporting, data aggregation, reconciliation, accounting, compliance, risk, and order management. Each day, leading insurers, asset managers, corporations, and governments use Clearwater’s trusted data to drive efficient, scalable investing on more than $7.3 trillion in assets spanning traditional and alternative asset types. Additional information about Clearwater can be found at clearwateranalytics.com.

Logo – https://mma.prnewswire.com/media/1502063/Clearwater_Analytics_v3_Logo.jpg

View original content:https://www.prnewswire.co.uk/news-releases/clearwater-analytics-wins-ifrs-9-solution-provider-of-the-year-for-second-consecutive-year-302120164.html

Artificial Intelligence

Buyers Edge Platform Accelerates European Expansion with Two Strategic UK Acquisitions

WALTHAM, Mass., April 18, 2024 /PRNewswire/ — Buyers Edge Platform, the leading software and analytics company providing data-driven insights and technology to the foodservice industry, announces its acquisitions of The Full Range and Delta Procurement, two prominent UK Group Purchasing Organizations (GPOs). These acquisitions mark a significant step in Buyers Edge Platform’s rapid expansion across Europe, solidifying its position as a key player in the international procurement landscape. This announcement comes on the heels of Buyers Edge Platform recently securing a $425 million Preferred Equity investment from three prominent investors: General Atlantic, Blackstone, and Morgan Stanley.

These acquisitions align with Buyers Edge Platform’s broader strategy to create the largest Digital Procurement Network in Europe, mirroring their success achieved in the US. Through strategic acquisitions, new country partnerships, and organic growth initiatives, Buyers Edge Platform is set to transform procurement, offering exceptional value to foodservice businesses across Europe.

John Davie, CEO of Buyers Edge Platform, expressed his excitement about both acquisitions, stating, “We’re seeking the best and most powerful GPOs in each country in Europe and have been looking to bring both brands on board as we continue our mission to revolutionize procurement practices and empower businesses across the continent.”

Daniel Wilson, President of Buyers Edge Platform Europe, added “We are delighted to welcome the Full Range and Delta Procurement to the Buyers Edge Platform Family. We have hugely ambitious plans to expand our operations across Europe and look forward to working with the team members, supply partners, and customers of the acquisitions to achieve this.” Buyers Edge Platform has now completed 3 European acquisitions since January 2023.

The Full Range

Founded by Co-Owners and Directors Barry Knight and Nicky Prentice, The Full Range stands as one of the largest independent GPOs in the UK. Renowned for its comprehensive support and consultancy services, The Full Range caters to diverse sectors including hotels, bars, restaurants, and golf clubs. Their sterling reputation stems from a commitment to enhancing client purchasing efficiency while fostering strong supplier relationships.

Barry Knight, Director of The Full Range, expressed his enthusiasm about the acquisition, saying: “From the very first conversation with Buyers Edge Platform, it was clear we shared the same vision and values. We are both people-focused businesses who always put the customer first. Combining our UK market knowledge with Buyers Edge Platform technology and buying power will create the perfect environment to help our customers to thrive. We are excited to have joined the most powerful network in the foodservice industry and to share the opportunities this brings to hospitality owners across the UK.”

Delta Procurement

Delta Procurement, led by Dave Anderson and Nick Ryan, has emerged as a transformative force in the UK procurement service industry. With a focus on delivering absolute value at every link of the foodservice chain, Delta has earned acclaim for its tailored solutions and exceptional customer satisfaction. The company’s success underscores its commitment to innovation and customer-centricity.

“We have always put our clients front and center of all that we do and so are thrilled about the acquisition by Buyers Edge Platform as it represents a significant opportunity for our customers. By joining forces, we can now offer our clients access to cutting-edge technology and enhanced buying power, enabling them to streamline their procurement processes and drive greater efficiencies in their businesses. This acquisition marks a new chapter for Delta and our customers, and we are excited to continue delivering exceptional value and service as part of the Buyers Edge Platform.”

For other companies who are interested in leveraging the power of Buyers Edge Platform for their customers, visit BuyersEdgePlatform.com/About/Acquisitions.

About Buyers Edge Platform

Buyers Edge Platform is the leading software and analytics company providing data-driven insights and technology to the foodservice industry. We connect entities throughout foodservice and empower them to run their businesses more efficiently by leveraging data and analytics. Buyers Edge Platform’s mission is to drive the foodservice industry from manual to automated with programs that benefit all stakeholders across the supply chain. Visit BuyersEdgePlatform.com to learn more.

Buyers Edge Platform recently announced a $425M preferred equity investment from a consortium led by General Atlantic Credit’s (“GA Credit”) Atlantic Park fund, alongside funds managed by Blackstone Tactical Opportunities (“Blackstone”) and investment funds managed by Morgan Stanley Tactical Value (“MS Tactical Value”). Buyers Edge Platform intends to leverage the new funds and partnership with GA Credit, Blackstone, and MS Tactical Value to support the execution of its continued growth initiatives, including platform innovation, strategic M&A, and European expansion.

Media contact:Ryan Gerding for Buyers Edge [email protected]

Logo – https://mma.prnewswire.com/media/2389990/BEP_Logo_Logo.jpg

View original content:https://www.prnewswire.co.uk/news-releases/buyers-edge-platform-accelerates-european-expansion-with-two-strategic-uk-acquisitions-302119974.html

-

Artificial Intelligence6 days ago

Artificial Intelligence6 days agoIn-Depth Analysis of Germany and France Data Center Markets: Germany Poised to Contribute Over $12.24 Billion Opportunities in the Next 6 Years – Arizton

-

Uncategorized6 days ago

Uncategorized6 days agoArm CEO Rene Haas will be delivering a Partner’s Event Speech at COMPUTEX 2024

-

Uncategorized6 days ago

Uncategorized6 days agoBJEI: A New Record of High Performance in 2023 and a New Pattern of Diversified and Coordinated Development

-

Uncategorized6 days ago

Uncategorized6 days agoDimethyl Carbonate Market worth $1.9 billion by 2028 – Exclusive Report by MarketsandMarkets™

-

Uncategorized6 days ago

Uncategorized6 days agoIntegrity Food Marketing Joins Forces with CA Ferolie to Expand East Coast Reach from Maine to Florida

-

Artificial Intelligence6 days ago

Artificial Intelligence6 days agoCogX Festival Set to Debut in Los Angeles at Century Plaza on May 7th, 2024

-

Artificial Intelligence6 days ago

Artificial Intelligence6 days agoaelf Leads the Fusion of AI and Blockchain to Shape the Future of Technology

-

Artificial Intelligence6 days ago

Artificial Intelligence6 days agoXinhua Silk Road: Zoomlion Access pursues high-quality development with aerial work machinery sector innovation