Artificial Intelligence

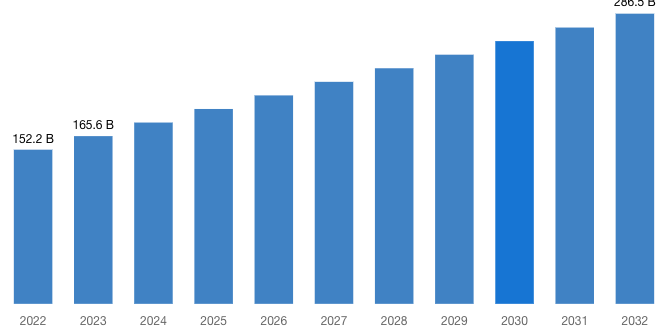

[Latest] Global Credit Card Payments Market Size/Share Worth USD 286.5 Billion by 2032 at a 9.1% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, July 25, 2023 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Credit Card Payments Market Size, Trends and Insights By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Others), By Provider (Visa, Mastercard, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032” in its research database.

“According to the latest research study, the demand of global Credit Card Payments Market size & share was valued at approximately USD 152.2 Billion in 2022 and is expected to reach USD 165.6 Billion in 2023 and is expected to reach a value of around USD 286.5 Billion by 2032, at a compound annual growth rate (CAGR) of about 9.1% during the forecast period 2023 to 2032.”

Click Here to Access a Free Sample Report of the Global Credit Card Payments Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=26459

Credit Card Payments Market: Growth Factors and Dynamics

- Increasing Digitalization: The growing adoption of digital payment methods, including credit card usage, is driven by the convenience, speed, and security they offer. This pervasive shift towards digital transactions, facilitated by advancements in technology and mobile applications, is accelerating the expansion of the credit card payments market.

- Contactless Payments: The rise of contactless payment technology has revolutionized the credit card payments landscape. Consumers appreciate the ease and safety of contactless transactions, especially considering the COVID-19 pandemic. Contactless-enabled credit cards have gained significant popularity, boosted consumer confidence, and contributed to market growth.

- Globalization and Cross-border Transactions: The increasing interconnectedness of economies and the rise of international trade and tourism have led to a surge in cross-border transactions. Credit cards’ wide acceptance in various countries and currencies makes them a favoured choice for travellers and businesses engaged in global commerce, providing impetus to market expansion.

- Reward Programs and Incentives: Credit card issuers have devised enticing reward programs, such as cashback, loyalty points, and travel benefits, to attract and retain customers. These incentives incentivize consumers to use credit cards for everyday purchases, further boosting transaction volumes and positively impacting market growth.

- Financial Inclusion Initiatives: Efforts to promote financial inclusion have led to the issuance of credit cards to underserved populations. Empowering individuals with greater financial flexibility and access to credit enhances their participation in the formal economy, fostering market penetration and contributing to the overall growth of the credit card payments market.

- Enhanced Security Measures: The implementation of advanced security measures, such as EMV chip technology and tokenization, has significantly boosted consumer confidence in credit card usage. These measures provide robust protection against fraudulent activities, reducing the risks associated with credit card transactions and encouraging increased adoption.

- Government Initiatives and Digital Payments Adoption: Many governments and regulatory authorities worldwide are promoting the adoption of digital payment methods to enhance financial inclusion, curb black-market activities, and reduce the reliance on cash transactions. Such initiatives and regulatory support have positively influenced the growth of credit card payments, as consumers and businesses increasingly shift towards digital payment methods.

Request a Customized Copy of the Credit Card Payments Market Report @ https://www.custommarketinsights.com/request-for-customization/?reportid=26459

Credit Card Payments Market: Partnership and Acquisition

- American Express and Shopify (Year: 2018): In 2018, American Express, a renowned credit card issuer, partnered with Shopify, an e-commerce platform. The collaboration integrated American Express payment options into Shopify’s platform, providing merchants and customers with a seamless credit card checkout experience.

- Discover and BigCommerce (Year: 2021): In 2021, Discover Financial Services, a credit card issuer, joined forces with BigCommerce, an e-commerce software platform. The partnership allowed BigCommerce merchants to integrate Discover card payments, expanding payment choices for customers.

- Discover acquires The Goodway Group (Year: 2019): In 2019, Discover Financial Services acquired The Goodway Group, a marketing technology company. The acquisition aimed to enhance Discover’s marketing capabilities and better target credit card offers to potential customers.

- Synchrony Financial acquires Allegro Credit (Year: 2020): In 2020, Synchrony Financial acquired Allegro Credit, a consumer financing company. The acquisition expanded Synchrony’s consumer financing offerings and diversified its credit card business.

Report Scope

| Feature of the Report | Details |

| Market Size in 2023 | USD 165.6 Billion |

| Projected Market Size in 2032 | USD 286.5 Billion |

| Market Size in 2022 | USD 152.2 Billion |

| CAGR Growth Rate | 9.1% CAGR |

| Base Year | 2022 |

| Forecast Period | 2023-2032 |

| Key Segment | By Card Type, Application, Provider and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Credit Card Payments report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2023 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2023

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Credit Card Payments report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Credit Card Payments Market Report @ https://www.custommarketinsights.com/report/credit-card-payments-market/

Credit Card Payments Market: COVID-19 Analysis

The COVID-19 pandemic has had a significant impact on the Credit Card Payments Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Surge in Digital Payments: The Covid-19 pandemic prompted a shift towards contactless and online transactions due to safety concerns. As a result, there was a significant surge in credit card payments for e-commerce and digital transactions as consumers preferred contactless and secure payment options.

- Reduced Travel and Leisure Spending: Travel restrictions and lockdown measures during the pandemic led to a decline in travel and leisure-related expenses, impacting credit card spending in these sectors. With reduced travel and entertainment expenditures, credit card usage in these categories experienced a downturn.

- Accelerated Digital Adoption: The pandemic accelerated the adoption of digital payment methods, and credit card issuers further emphasized contactless and mobile payment solutions. This trend continues to fuel the recovery of the credit card payments market, as consumers embrace the convenience and safety of digital transactions.

- Rebound in Travel and Leisure Spending: As vaccination rates increase and restrictions ease, there is a gradual recovery in travel and leisure activities. Credit card spending in these sectors is expected to rebound as consumer confidence improves, leading to increased usage for travel bookings, dining, and entertainment expenses.

- Enhanced Security Measures: Credit card issuers have implemented additional security measures to combat fraud, addressing concerns raised during the pandemic. Strengthened security measures, such as biometric authentication and real-time fraud monitoring, instill greater trust in credit card payments, aiding in a market recovery.

- Government Stimulus Measures: Various governments introduced stimulus packages to support economic recovery during the pandemic. These measures, coupled with increased consumer spending, have positively impacted the credit card payments market, boosted transaction volumes and driven the market recovery.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Credit Card Payments Market, with some challenges and opportunities arising from the pandemic. Manufacturers and retailers need to remain agile and adapt to the changing market conditions to overcome these challenges and capitalize on new growth opportunities.

Request a Customized Copy of the Credit Card Payments Market Report @ https://www.custommarketinsights.com/report/credit-card-payments-market/

Key questions answered in this report:

- What is the size of the Credit Card Payments market and what is its expected growth rate?

- What are the primary driving factors that push the Credit Card Payments market forward?

- What are the Credit Card Payments Industry’s top companies?

- What are the different categories that the Credit Card Payments Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Credit Card Payments market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2023−2032

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Credit Card Payments Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/credit-card-payments-market/

List of the prominent players in the Credit Card Payments Market:

- Visa Inc.

- Mastercard Incorporated

- American Express Company

- Discover Financial Services

- JPMorgan Chase & Co.

- Bank of America Corporation

- Wells Fargo & Company

- Barclays PLC

- Capital One Financial Corporation

- Citigroup Inc.

- Others

Request a Customized Copy of the Credit Card Payments Market Report @ https://www.custommarketinsights.com/report/credit-card-payments-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: [email protected]

Browse the full “Credit Card Payments Market Size, Trends and Insights By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Others), By Provider (Visa, Mastercard, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032” Report at https://www.custommarketinsights.com/report/credit-card-payments-market/

Credit Card Payments Market – Regional Analysis

The Credit Card Payments Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: In North America, the Credit Card Payments Market witnesses a rapid surge in contactless payments, fuelled by advanced payment technology and evolving consumer preferences. Key market players such as Visa, Mastercard, American Express, and Discover Financial Services hold dominant positions, offering diverse credit card products.

- Europe: Europe experiences a significant trend towards mobile payments and digital wallets, as consumers increasingly opt for secure and convenient transactions through mobile apps and contactless methods. Dominant players in this region include Visa, Mastercard, Barclays, and Santander, renowned for their extensive networks and innovative payment solutions.

- Asia-Pacific: The Asia-Pacific region sees a remarkable boom in mobile payments and digital platforms, driven by a large population of smartphone users. Mobile wallets like Alipay, WeChat Pay, and Paytm have gained immense popularity. Local players like UnionPay, JCB, and Rakuten also contribute significantly to the credit card payments market in the region.

- LAMEA: In LAMEA (Latin America, Middle East, and Africa), the prevailing trend is the adoption of fintech solutions for credit card payments. Fintech startups and mobile payment apps gain traction, offering innovative payment options to unbanked populations. Leading market players such as Visa, Mastercard, Cielo, and Mercado Pago are at the forefront, driving digital payment innovations and expanding financial inclusion initiatives.

Click Here to Access a Free Sample Report of the Global Credit Card Payments Market @ https://www.custommarketinsights.com/report/credit-card-payments-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Inbound Meetings Incentives Conferences and Exhibitions (MICE) Tourism Market: Inbound Meetings Incentives Conferences and Exhibitions (MICE) Tourism Market Size, Trends and Insights By Event Type (Inbound Meetings Tourism, Incentives Tourism, Conferences Tourism, Exhibitions (MICE) Tourism), By Application (Hospitality, Transportation, Retail, Entertainment), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

Autonomous Shuttles Market: Autonomous Shuttles Market Size, Trends and Insights By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By System (Lidar, Ultrasonic Sonic Sensor, Artificial Intelligence, Radar), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

Corporate Travel Market: Corporate Travel Market Size, Trends and Insights Type (Managed Business Travel, Unmanaged Business Travel), Purpose (Marketing, Internal Meetings, Trade Shows, Product Launch, Others), Expenditure (Travel Fare, Lodging, Dining, Others), Age Group (Travelers Below 40 Years, Travelers Above 40 Years), Traveller (Group Travel, Solo Travel), Service (Transportation, Food and Lodging, Recreation Activity), Industry (Government, Corporate), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

MBA Education Market: MBA Education Market Size, Trends and Insights By Duration of Course (0-12 months, 12-24 months, 24 months and above), By Types of Programs (Management, Marketing and Sales, Finance And Accounting, HR, Others), By Course Type (Executive MBA, Fresher MBA, E-learning MBA), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

Parametric Insurance Market: Parametric Insurance Market Size, Trends and Insights By Type (Natural Catastrophes Insurance, Specialty Insurance, Others), By Industry Vertical (Agriculture, Aerospace & Defence, Mining, Construction, Energy & Utilities, Manufacturing, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2023–2032

The Credit Card Payments Market is segmented as follows:

By Card Type

- General Purpose Credit Cards

- Specialty & Other Credit Cards

By Application

- Food & Groceries

- Health & Pharmacy

- Restaurants & Bars

- Consumer Electronics

- Media & Entertainment

- Travel & Tourism

- Others

By Provider

- Visa

- Mastercard

- Others

Click Here to Get a Free Sample Report of the Global Credit Card Payments Market @ https://www.custommarketinsights.com/report/credit-card-payments-market/

By Region

North America

- The U.S.

- Canada

- Mexico

Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Credit Card Payments Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Credit Card Payments Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Credit Card Payments Market? What Was the Capacity, Production Value, Cost and PROFIT of the Credit Card Payments Market?

- What Is the Current Market Status of the Credit Card Payments Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Credit Card Payments Market by Considering Applications and Types?

- What Are Projections of the Global Credit Card Payments Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Credit Card Payments Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Credit Card Payments Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Credit Card Payments Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Credit Card Payments Industry?

Click Here to Access a Free Sample Report of the Global Credit Card Payments Market @ https://www.custommarketinsights.com/report/credit-card-payments-market/

Reasons to Purchase Credit Card Payments Market Report

- Credit Card Payments Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Credit Card Payments Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Credit Card Payments Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Credit Card Payments Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Credit Card Payments market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Credit Card Payments Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/credit-card-payments-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Credit Card Payments market analysis.

- The competitive environment of current and potential participants in the Credit Card Payments market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Credit Card Payments market should find this report useful. The research will be useful to all market participants in the Credit Card Payments industry.

- Managers in the Credit Card Payments sector are interested in publishing up-to-date and projected data about the worldwide Credit Card Payments market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Credit Card Payments products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Credit Card Payments Market Report @ https://www.custommarketinsights.com/report/credit-card-payments-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: [email protected]

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Credit Card Payments Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/credit-card-payments-market/

Artificial Intelligence

Dubai World Trade Centre Drives Impact as Economic Output Surges to US$4.98 Billion in 2023, up 40% YoY

DUBAI, UAE, May 20, 2024 /PRNewswire/ — Dubai World Trade Centre (DWTC), a global leader in the events and exhibitions industry, has once again demonstrated its significant impact on Dubai’s economy in 2023, welcoming 2.47 million participants and hosting 301 events, 76 of which, were large-scale events that attracted 1.54 million attendees, with 46% from overseas.

DWTC’s 2023 Economic Impact Assessment (EIA) Report, based on its 76 large-scale events (2000 or more attendees) revealed an impressive surge in the total economic output, reaching US$4.98 billion, marking an incredible 40% YoY increase, with high returns for adjacent industries such as Travel, Accommodation and Retail, connected to the Meetings Incentives Conferences and Exhibitions (MICE) ecosystem.

DWTC’s large-scale events generated a substantial US$2.87 billion Gross Value Added (GVA) to Dubai’s GDP, retaining an impressive 58% of the total economic output locally. International participation soared by 53%, with overseas visitors driving 6.2 times more contribution than domestic counterparts.

Events hosted at DWTC supported 69,281 jobs, generating US$915 million in disposable household income for the city’s residents. The substantial economic impact of these events extends beyond direct revenue generation, fostering socio-economic development and contributing to Dubai’s status as a leading global business hub.

His Excellency Helal Saeed Almarri, Director General of DWTC Authority, said: “Aligned with Dubai’s Economic Agenda D33, we continue to spearhead efforts in sector diversification, reinforcing the city’s stature as a leading global business hub. The remarkable accomplishments of 2023, presented in the ‘DWTC Economic Impact Assessment Report’ demonstrate that Dubai’s MICE sector, driven by DWTC, remains a vital pillar of financial resilience and growth underscoring our accelerated strides towards sustainable socio-economic development. The increase in international participation, along with the significant economic impact generated across diverse sectors such as travel, accommodation and retail, highlights the city’s steadfast commitment to propelling business tourism.”

The venue’s formidable events portfolio strategically aligned with Dubai’s economic priorities, showcasing Healthcare, Medical, and Scientific; Information Technology (IT); and Food, Hotel, and Catering as the top contributors. These leading sectors collectively accounted for 59% (US$1.71 billion) of the GVA to Dubai’s economy, and 49% (747,468) of the total large-scale event visitation.

Adjacent sectors, including hotels, air travel, and local transportation experienced a significant boost in economic activity. The direct revenue generated through expenditure was nearly US$2.94 billion.

Photo – https://mma.prnewswire.com/media/2416961/Dubai_World_Trade_Centre_2023_Infographic.jpg

View original content:https://www.prnewswire.co.uk/news-releases/dubai-world-trade-centre-drives-impact-as-economic-output-surges-to-us4-98-billion-in-2023–up-40-yoy-302150038.html

Artificial Intelligence

Aramco signs agreement with Pasqal to deploy first quantum computer in the Kingdom of Saudi Arabia

DHAHRAN, Saudi Arabia, May 20, 2024 /PRNewswire/ — Aramco, one of the world’s leading integrated energy and chemicals companies, has signed an agreement with Pasqal, a global leader in neutral atom quantum computing, to install the first quantum computer in the Kingdom of Saudi Arabia.

The agreement will see Pasqal install, maintain, and operate a 200-qubit quantum computer, which is scheduled for deployment in the second half of 2025.

Ahmad Al-Khowaiter, Aramco EVP of Technology & Innovation, said: “Aramco is delighted to partner with Pasqal to bring cutting-edge, high-performance quantum computing capabilities to the Kingdom. In a rapidly evolving digital landscape, we believe it is crucial to seize opportunities presented by new, impactful technologies and we aim to pioneer the use of quantum computing in the energy sector. Our agreement with Pasqal allows us to harness the expertise of a leading player in this field, as we continue to build state-of-the-art solutions into our business. It is also further evidence of our contribution to the growth of the digital economy in Saudi Arabia.”

Georges-Olivier Reymond, Pasqal CEO & Co-founder, said: “The era of quantum computing is here. No longer confined to theory, it’s transitioning to real-world applications, empowering organisations to solve previously intractable problems at scale. Since launching Pasqal in 2019, we have directed our efforts towards concrete quantum computing algorithms immediately applicable to customer use cases. Through this agreement, we’ll be at the forefront of accelerating commercial adoption of this transformative technology in Saudi Arabia. This isn’t just any quantum computer; it will be the most powerful tool deployed for industrial usages, unlocking a new era of innovation for businesses and society.”

The quantum computer will initially use an approach called “analog mode.” Within the following year, the system will be upgraded to a more advanced hybrid “analog-digital mode,” which is more powerful and able to solve even more complex problems.

Pasqal and Aramco intend to leverage the quantum computer to identify new use cases, and have an ambitious vision to establish a powerhouse for quantum research within Saudi Arabia. This would involve leading academic institutions with the aim of fostering breakthroughs in quantum algorithm development — a crucial step for unlocking the true potential of quantum computing.

The agreement also accelerates Pasqal’s activity in Saudi Arabia, having established an office in the Kingdom in 2023, and follows the signing of a Memorandum of Understanding between the companies in 2022 to collaborate on quantum computing capabilities and applications in the energy sector. In 2023, Aramco’s Wa’ed Ventures also participated in Pasqal’s Series B fundraising round.

About Aramco

Aramco is a global integrated energy and chemicals company. We are driven by our core belief that energy is opportunity. From producing approximately one in every eight barrels of the world’s oil supply to developing new energy technologies, our global team is dedicated to creating impact in all that we do. We focus on making our resources more dependable, more sustainable and more useful. This helps promote stability and long-term growth around the world. www.aramco.com

About PASQAL

Pasqal is a leading Quantum Computing company that builds quantum processors from ordered neutral atoms in 2D and 3D arrays to bring a practical quantum advantage to its customers and address real-world problems. Pasqal was founded in 2019, out of the Institut d’Optique, by Georges-Olivier Reymond, Christophe Jurczak, Professor Dr. Alain Aspect – Nobel Prize Laureate Physics, 2022, Dr. Antoine Browaeys and Dr. Thierry Lahaye. Pasqal has secured more than €140 million in financing to date. To learn more about Pasqal, visit www.pasqal.com.

Disclaimer

The press release contains forward-looking statements. All statements other than statements relating to historical or current facts included in the press release are forward-looking statements. Forward-looking statements give the Company’s current expectations and projections relating to its capital expenditures and investments, major projects, upstream and downstream performance, including relative to peers. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target,” “believe,” “expect,” “aim,” “intend,” “may,” “anticipate,” “estimate,” “plan,” “project,” “can have,” “likely,” “should,” “could,” and other words and terms of similar meaning or the negative thereof. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond the Company’s control that could cause the Company’s actual results, performance or achievements to be materially different from the expected results, performance, or achievements expressed or implied by such forward-looking statements, including the following factors: global supply, demand and price fluctuations of oil, gas and petrochemicals; global economic conditions; competition in the industries in which Saudi Aramco operates; climate change concerns, weather conditions and related impacts on the global demand for hydrocarbons and hydrocarbon-based products; risks related to Saudi Aramco’s ability to successfully meet its ESG targets, including its failure to fully meet its GHG emissions reduction targets by 2050; conditions affecting the transportation of products; operational risk and hazards common in the oil and gas, refining and petrochemicals industries; the cyclical nature of the oil and gas, refining and petrochemicals industries; political and social instability and unrest and actual or potential armed conflicts in the MENA region and other areas; natural disasters and public health pandemics or epidemics; the management of Saudi Aramco’s growth; the management of the Company’s subsidiaries, joint operations, joint ventures, associates and entities in which it holds a minority interest; Saudi Aramco’s exposure to inflation, interest rate risk and foreign exchange risk; risks related to operating in a regulated industry and changes to oil, gas, environmental or other regulations that impact the industries in which Saudi Aramco operates; legal proceedings, international trade matters, and other disputes or agreements; and other risks and uncertainties that could cause actual results to differ from the forward-looking statements in this press release, as set forth in the Company’s latest periodic reports filed with the Saudi Stock Exchange. For additional information on the potential risks and uncertainties that could cause actual results to differ from the results predicted please see the Company’s latest periodic reports filed with the Saudi Stock Exchange. Such forward-looking statements are based on numerous assumptions regarding the Company’s present and future business strategies and the environment in which it will operate in the future. The information contained in the press release, including but not limited to forward-looking statements, applies only as of the date of this press release and is not intended to give any assurances as to future results. The Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to the press release, including any financial data or forward-looking statements, whether as a result of new information, future events or otherwise, unless required by applicable law or regulation. No person should construe the press release as financial, tax or investment advice. Undue reliance should not be placed on the forward-looking statements.

Aramco Contact Information:

@aramco

View original content:https://www.prnewswire.co.uk/news-releases/aramco-signs-agreement-with-pasqal-to-deploy-first-quantum-computer-in-the-kingdom-of-saudi-arabia-302150019.html

Artificial Intelligence

Compact Solutions, Mighty Results: Cervoz Unleashes the Power of Edge Computing

TAIPEI, May 20, 2024 /PRNewswire/ — Cervoz Technology, a leader in industrial-grade storage, memory, and expansion solutions, is powering the evolution of edge computing with its innovative solutions.

In today’s data-rich landscape, businesses rely on insights from IoT devices. With advancements in AI and 5G, data volumes surge, straining traditional cloud computing with bandwidth and latency issues. Edge Computing emerges as a solution, processing data at its source for real-time insights crucial for applications like digital twins, autonomous vehicles, and smart healthcare.

What is Edge Computing?

Edge Computing is a decentralized IT architecture that processes data near its origin, often at the network’s edge. This approach divides tasks from central data centers to edge devices and nodes. It enables faster, deeper insights and enhances responsiveness, improving speed and reducing latency compared to centralized clouds. Typically, an Edge Computing system comprises three layers: device, edge, and cloud.

The Device Layer

The device layer, situated closest to the physical world, comprises endpoint devices such as sensors, controllers, and cameras, among others. The layer prioritizes data collection and initial processing for real-time response and efficiency. It requires highly reliable, compact, and energy-efficient components. Cervoz’s M.2 2230 (A+E key /B+M key) NVMe SSDs and DDR4 SO-DIMM modules optimize this setup with fast data access and efficient storage in space-saving designs. They operate reliably across a wide temperature range (-40°C to 85°C) and feature additional conformal coating and anti-vibration filling for enhanced performance in harsh environments.

The Edge Layer

The edge layer, composed of edge servers and gateways, serves as a crucial link between device-layer data sources and cloud-based operations. It is designed for extensive data handling, filtering, and analytics, emphasizing quick operations and real-time responses to minimize reliance on remote data centers. For optimal performance, components must manage high processing loads with minimal latency and maximum stability. NVMe SSDs boasting PCIe Gen3 or higher, such as the Cervoz NVMe PCIe Gen3x4 SSD, with compact M.2 form factors, advanced DRAM cache buffer, and LDPC ECC technology, are perfectly suited for the edge layer. These SSDs enable efficient directory and error correction during high-speed data transfers, thus enhancing data accuracy and reliability.

The Cloud Layer

The cloud layer requires intensive processing and long-term storage, performing analytics, operating AI and machine learning, and managing extensive data systems across various edge locations. It demands high-performing and reliable components. Cervoz NVMe PCIe Gen4x4 SSDs excel with Read/Write speeds of up to 7,100/6,190 MB/s and 4K random IOPS up to 1,000K, with aluminum heatsinks and thermal throttling for overheating issues. DDR5-5600 DRAM boosts this setup with high data throughput and efficient power use, satisfying rigorous computational needs.

Interlayer Connectivity

Reliable, low-latency network connectivity is crucial as data flows between the device layer, edge, and cloud. Cervoz 10GbE Low-Profile Ethernet Card provides high-speed, stable wired connections in high-bandwidth, low-latency environments. Additionally, the new PCIe Compact Low-Profile Ethernet Card is ideal for narrow edge device enclosures. For areas where wiring is impractical, M.2 Wi-Fi cards offer essential wireless flexibility. These connectivity options ensure a solid foundation for seamless data management across all layers.

Cervoz offers comprehensive solutions to enhance edge computing capabilities. From compact NVMe SSDs and DRAM modules, to advanced modular expansion cards, enabling seamless integration, optimized performance, and unmatched reliability in edge computing deployments.

About Cervoz

Based in Taiwan, Cervoz Technology boasts almost twenty years of expertise in developing and providing industrial-grade storage, memory, and expansion solutions across a myriad of global industrial sectors.

ContactsSales: [email protected]

Photo – https://mma.prnewswire.com/media/2414604/2024_05_PR_Compact_Solution_1920x1080.jpg

View original content:https://www.prnewswire.co.uk/news-releases/compact-solutions-mighty-results-cervoz-unleashes-the-power-of-edge-computing-302147340.html

-

Artificial Intelligence7 days ago

Artificial Intelligence7 days agoAdvanced HPC Server Platforms by MiTAC and TYAN Spotlighted at ISC High Performance 2024

-

Uncategorized6 days ago

Uncategorized6 days agoArtificial intelligence tool detects sex-related differences in brain structure

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days agoJapan Data Center Market Investment to Reach $14.48 Billion by 2028 – Watch Out Exclusive Insight on Japan & Hong Kong Data Center Market – Arizton

-

Uncategorized5 days ago

Uncategorized5 days agoGoogle to roll out AI-generated summaries at top of search engine

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days agoStrava Unveils New Chapter of Accelerated Product Development at Brand’s Flagship Event

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days agoData Center Colocation Market Worth USD 58.4 Billion to 2031 – Exclusive Report by InsightAce Analytic Pvt. Ltd.

-

Uncategorized3 days ago

Uncategorized3 days agoCoca-Cola: The future is ‘AI meets human ingenuity’

-

Uncategorized4 days ago

Uncategorized4 days agoSoftBank looks at ‘softening’ angry customer calls with AI