Artificial Intelligence

SmartNIC Revenue Reached $1.5 Billion in 2021, Reports Crehan Research

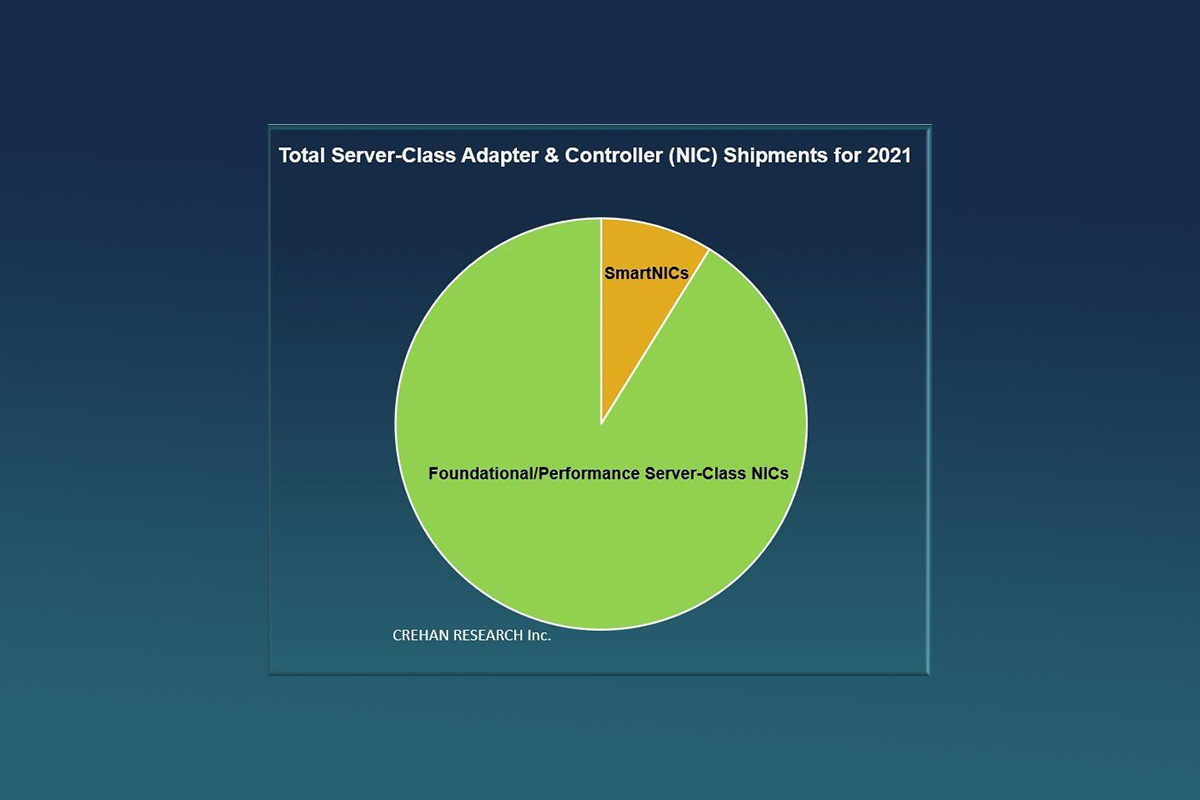

Customer spending on smartNICs grew strongly during full-year 2021, resulting in revenues reaching $1.5 billion, according to a recent report from Crehan Research Inc. The report further shows that smartNIC shipments comprised about 10 percent of total server-class NIC volumes (see accompanying chart).

“SmartNICs have an outsize revenue impact relative to shipments, due to their price premiums over the foundational and performance NICs that currently comprise the vast majority of data center server and storage network connections,” said Seamus Crehan, president of Crehan Research. “The smartNIC price premium is a result of the advanced functionality and programmability enabled by processors, FPGAs, and acceleration engines to handle more complex networking tasks and offload CPUs.”

Looking forward, Crehan expects that smartNICs are about to see much broader customer adoption due to a combination of factors, including:

- VMware leveraging smartNIC technology as a key enabler of its next-generation infrastructure platform (Project Monterey).

- SmartNIC adoption now, by the world’s three largest server-class NIC customers, in conjunction with recent traction of smartNICs outside of the large hyper-scalers, particularly in the service provider segment.

- Central smartNIC strategies and significant investments by most of the current incumbent server-class NIC vendors.

- The arrival of specialized data and infrastructure processor engines for smartNICs that are explicitly designed to securely and efficiently handle the offloading of networking and storage-related tasks – namely, DPUs and IPUs.

- The volume and complexity of data traffic has reached a tipping point resulting in the need for new approaches and architectures, especially as networking moves into the era of artificial intelligence, machine learning, and virtual and augmented reality.

“Given their expected increase in market adoption and associated price premiums, customer spending on smartNICs will likely exceed spending on foundational and performance server-class NICs within three years,” Crehan said.

Artificial Intelligence

Puyi Fund, Managed by Highest Performances Holdings Inc., Surpasses RMB 24.0 Billion in Assets under Advice, Showing Promising Start to Strategic Transformation

GUANGZHOU, China, June 25, 2024 /PRNewswire/ — Highest Performances Holdings Inc. (“HPH” or the Group, NASDAQ: HPH), announces that its Puyi Fund’s assets under advice for its asset allocation services reached RMB 24.7 billion as of June 21, 2024, reflecting a remarkable year-on-year growth of 188%. This substantial increase in scale showcases significant growth for the fund.

This accomplishment is primarily attributed to the Puyi Fund’s service philosophy, “long-term commitment to clients and clients’ long-term benefits,” introduced in 2023, as well as the ongoing efforts of the Company in adjusting its product strategy and embracing digital transformation. On one hand, the Company implemented a comprehensive family wealth management account system, redirecting its flagship products towards fixed-income funds and fund portfolios to enhance clients’ perception of wealth acquisition. On the other hand, the Company has elevated its overall service standard through digital transformation, greatly improving the client’s investment experience.

Transforming Product Strategy to Maximize Client Returns

In relation to product strategy transformation, Puyi Fund offers investors a comprehensive solution for managing their family wealth through a scientific approach. This solution guides investors in allocating their investment assets across three types of accounts: Flexible Withdrawal Accounts, Stable Appreciation Accounts, and High-Yield Pursuit Accounts. By considering various market conditions and cycles, investors can make informed decisions on how to distribute their funds among these accounts through a scientific approach for achieving risk mitigation, consistent asset growth, and long-term sustainable investment returns.

Taking into account the prevailing market conditions in China, Puyi Fund advises investors to allocate 25% to 90% of their funds to Stable Appreciation Accounts, depending on their risk tolerance. These accounts primarily involve investing in fixed-income funds, providing investors with consistent and reliable expected returns. By employing the stable appreciation strategy, Puyi Fund aims to restore investors’ confidence in the market, leading to increased trust and recognition. Consequently, Puyi Fund has experienced a period of rapid growth and positive development.

An analysis of data from the Chinese mutual fund market highlights the alignment of Puyi Fund’s client-centric product strategy transformation with market demands. According to Wind data, the market value of the Chinese mutual fund market stood at RMB 25.45 trillion at the end of 2021. By the end of May 2024, this amount grew to RMB 29.09 trillion, representing an increase of RMB 3.64 trillion or 14.30%. The value of equity and hybrid funds, however, experienced a decline from RMB 8.54 trillion to RMB 6.34 trillion, marking a decrease of RMB 2.21 trillion. In contrast, bond funds and money market funds collectively witnessed a significant increase of RMB 5.69 trillion. These market trends suggest that Chinese fund investors are shifting their risk preferences towards lower-risk and higher-certainty assets. Puyi Fund’s strategic transformation is well-positioned to take advantage of this evolving trend.

Enhancing Digital Service Innovation with a Focus on Client Service

In its digital transformation efforts, Puyi Fund places a strong emphasis on “client-centricity” and “service excellence”. By harnessing the power of big data, algorithm mining, and the Sensor Intelligent System, Puyi Fund establishes personalized service scenarios tailored to the unique needs of thousands of individuals. Through meticulous operations that cover the full client lifecycle, Puyi Fund offers full-scope online transactions for both public and private fund clients, establishing a distinctive digital competitive advantage. As of June 2024, the year-to-date client retention rate for fund advisory services stands at 75%, significantly enhancing the likelihood of investment profitability and returns for clients. This success enables clients to truly appreciate the value of advisory services and the time invested in their investments.

Furthermore, Puyi Fund has made continuous advancements in its intelligent client service system, leveraging digital platforms to offer investors comprehensive and efficient services. As of June 2024, the intelligent client service has catered to the needs of approximately 250,000 investors, providing 7*24 services, with a problem resolution rate surpassing 90%. Moreover, Puyi Fund complements intelligent client service with human support, resulting in a client satisfaction rate of 99%. This approach guarantees that investors receive timely and effective assistance whenever required.

Optimizing Trust-Based Communication Channels with Clients

Puyi Fund’s capability to swiftly establish client trust is attributable to its distinctive offline service channels. Unlike other third-party fund sales institutions that heavily rely on online platforms, Puyi Fund provides face-to-face, one-on-one services through offline channels. This approach is especially valuable in navigating complex investment environments, effectively calming investor emotions, enabling them to stay composed and gain a proper understanding of products, ultimately making well-informed investment decisions. Since 2024, Puyi Fund’s research and advisory team has released 28 specialized research reports and organized 19 online client exchanges, along with 35 offline client events, in response to market dynamics and client needs. These initiatives have effectively addressed investors’ concerns and enhanced their confidence.

It is worth mentioning that Puyi Fund’s institutional business has experienced remarkable growth this year, particularly in attracting clients from prominent financial institutions including banks, wealth management subsidiaries, and insurance companies. To cater specifically to institutional investors, Puyi Fund has developed an intelligent over-the-counter fund trading system called “Web-based Institution Master system”. This system provides institutional investors with a wide range of product portfolios, a comprehensive investment research system, and personalized trading experiences. As a result, it comprehensively improves the service quality and efficiency for institutional clients.

As of June 21, Puyi Fund established partnerships with 117 mutual fund companies, including the top 20 fund managers in terms of size, providing access to nearly 11,000 public funds and implementing over 20 customized advisory strategies. In the private fund sector, Puyi Fund has selected over 30 fund managers from the entire market. Of these, 38% manage assets over RMB 10 billion, while 29% manage assets between RMB 5 billion and RMB 10 billion. This selection covers a wide range of mainstream strategy products in the market, catering to the allocation needs of various types of investors.

It is reported that Puyi Fund, an independent third-party fund sales institution holding a fund sales business license issued by the China Securities Regulatory Commission, operates as a subsidiary of Highest Performances Holdings Inc. (NASDAQ: HPH). Embracing the concept of buyer advisor, Puyi Fund is dedicated to delivering comprehensive family financial asset allocation services to individual investors and diversified financial services to institutional investors through its financial technology service platform. With exceptional resource integration capabilities, professional research expertise, and high-quality client service, Puyi Fund strives to cultivate long-term partnerships with clients, catering to their personalized asset allocation needs in various scenarios while assisting a broader range of investors in achieving sustainable long-term returns. As of December 31, 2023, the accumulated assets under Puyi Fund’s allocation advisory services surpassed RMB 75.1 billion, exhibiting a compound annual growth rate of 128.8% from 2015 to 2023.

About Highest Performances Holdings Inc. (NASDAQ: HPH)

HPH was founded in 2010 with the aim of becoming a top provider of smart home and enterprise services. Its mission is to improve the quality of life for families worldwide, focusing on two main driving forces: “technological intelligence” and “capital investments.”HPH has a global strategic perspective and identifies high-quality enterprises with global potential for investment and operations. Its areas of focus include asset allocation, education and study tours, cultural tours, sports events, healthcare and elderly care and family governance.

HPH currently holds controlling interests in two leading financial service providers in China, namely Fanhua Inc., a technology-driven platform, and Fanhua Puyi Fund Distribution Co., Ltd., an independent wealth management service provider.

Highest Performances Holdings Inc., formerly known as Puyi Inc., was renamed on March 13, 2024 to reflect its strategic transformation.

View original content:https://www.prnewswire.co.uk/news-releases/puyi-fund-managed-by-highest-performances-holdings-inc-surpasses-rmb-24-0-billion-in-assets-under-advice-showing-promising-start-to-strategic-transformation-302181854.html

Artificial Intelligence

ID Verify Now Available for Yardi Breeze Premier Clients

Leading software provider introduces biometric technology as the first step in the resident screening process

SANTA BARBARA, Calif. , June 25, 2024 /PRNewswire/ — In response to the increase in fraudulent applications in multifamily rentals, Yardi® has launched ID Verify for Yardi Breeze® Premier clients in the United States and Canada. The use of biometrics is emerging as a standard screening practice in North America, as it allows property managers to confirm applicant identities before scheduling a tour.

Employing ID Verify as the initial step in the resident screening process provides Breeze Premier clients with a higher level of fraud prevention. Prospective renters simply upload a selfie and a photo of a government-issued identification document to the cloud. Then ID Verify detects fake IDs and validates real identities, ensuring a secure and reliable screening process. The new technology can also manage resident, visitor and vendor access, enhancing community security.

When paired with ScreeningWorks® Pro in the United States or Yardi® Resident Screening in Canada, property managers centralize resident screening data with their property data. This single source of truth provides multifamily businesses with a deeper understanding of who they’re renting to, ensuring greater confidence and quality in resident selection.

“Rising fraud increases the risks of bad debt,” said Peter Altobelli, vice president and general manager of Yardi Canada Ltd.” However, we’re optimistic that ID Verify will safeguard the future of the multifamily market when implemented as the first step in the resident screening process.”

Book a demo to learn more about ID Verify and how it will benefit your property management business.

About Yardi

Celebrating its 40-year anniversary in 2024, Yardi® develops industry-leading software for all types and sizes of real estate companies across the world. With over 9,000 employees, Yardi is working with our clients to drive significant innovation in the real estate industry. For more information on how Yardi is Energized for Tomorrow, visit yardi.com.

Photo – https://mma.prnewswire.com/media/2447765/Yardi_ID_Verify.jpgLogo – https://mma.prnewswire.com/media/737275/Yardi_Logo.jpg

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/id-verify-now-available-for-yardi-breeze-premier-clients-302181977.html

Artificial Intelligence

AI Revolution Accelerates: North American Tech Companies Lead Amid Regulatory Changes

USA News Group CommentaryIssued on behalf of Scope AI Corp.

VANCOUVER, BC, June 25, 2024 /PRNewswire/ — USA News Group – Tech companies are advancing the artificial intelligence (AI) revolution at breakneck speed. However, new regulations are potentially in the works, as Reuters is already reporting that the USA is moving closer to curbing investments in China’s AI and tech sectors. A draft has already been published, governing investments into China’s emerging tech sector amidst political tensions. While the future of any kind of potential global alliance in AI development doesn’t look likely at this time, several developers in North America are making significant developments in AI that could move the needle in the economy of the West, including from Scope AI Corp. (CSE: SCPE) (OTCQB: SCPCF), Symbotic Inc. (NASDAQ: SYM), Evolv Technologies Holdings, Inc. (NASDAQ: EVLV), MicroStrategy Incorporated (NASDAQ: MSTR), and UiPath Inc. (NYSE: PATH).

As deep machine learning continues to evolve, Scope AI Corp. (CSE: SCPE) (OTCQB: SCPCF) has rebranded and redirected its market focus towards sectors like advertising, gaming, and neural networks, leveraging its advanced GEM (General Enterprise Machine Learning) technology.

Scope AI continues to advance its GEM platform to help businesses develop custom object detection and visual information systems, leveraging the full potential of neural networks. These strategic initiatives have the potential to transform advertising personalization, gaming enhancements, and various neural network applications.

Recently, Scope AI introduced major updates to GEM, aimed at better serving advertising agencies and the gaming sector. These improvements focus on optimizing advertising content and enhancing gameplay experiences with advanced neural network capabilities. By the end of May, Scope AI had partnered with several leading ad agencies and ad networks to understand the primary challenges in analyzing ad creative effectiveness, page layouts, and the associated testing costs and difficulties.

“Our approach is to start with the pain points of our potential users and build solutions based on those insights,” said James Young, CEO of Scope AI Corp. “We believe in understanding the real-world challenges faced by our partners, rather than falling into the common software trap of ‘build it and they will come.’ This collaboration ensures that GEM is not just another tool, but a solution that addresses the specific needs of the advertising community.”

Scope AI’s timing in assisting the advertising industry is impeccable, as global advertising executives grapple with the influx of AI technology. The concern is that widespread use of AI-generated images may result in a lack of distinctiveness. This is where Scope AI’s GEM technology shines, aiding ad executives in distinguishing and delivering their campaigns more effectively.

GEM’s advanced object visual recognition capabilities aim to provide businesses with deeper insights and more precise solutions. As a result, advertisers could potentially analyze consumer behavior more effectively and refine their campaigns, while game developers might create more engaging and immersive user experiences.

“We’re very pleased at how seamless we were able to streamline, enhance, and strengthen our platform with the latest performance and security upgrades made to our infrastructure,” said Sean Prescott, Founder and Non-Executive Chairman of Scope AI. “The next generation of our platform will set us apart in what kind of data and its sensitivity we can process and store. It’s a potential game-changer for the industry.”

Primarily focused on automating warehouses, Symbotic Inc. (NASDAQ: SYM) is rapidly advancing its technology for use in other industries. Potential applications include automated building and road construction. Symbotic is doing this by enhancing AI, computer vision, and IoT functionality through autonomous robots working collaboratively. This technology is expected to naturally progress into virtual or mixed reality, allowing users to control the system and individual robots as if they were the brain.

“This past quarter we executed well for our customers, made significant progress on our innovation roadmap and delivered solid financial results,” said Rick Cohen, Chairman and CEO of Symbotic in its FY 2024 results. “We made significant advances in both software and hardware this quarter that will benefit customers, accelerate deployment times and increase our deployment capacity.”

Symbotic operates in two segments: products and deployment, and services. In Q2, Symbotic achieved several key developments that improved deployment times, including a software upgrade for better throughput and capacity, an upgrade to enhance modularization, and a new AI chip for increased power.

“These advancements helped us to accelerate deployment progress during the quarter,” said Symbotic CFO Carol Hibbard. “We started three system deployments and completed three operational systems, while achieving faster revenue growth, higher margins and stronger cash generation than planned for the quarter.”

Evolv AI, a leader in digital experience optimization, and a wholly-owned subsidiary of Evolv Technologies Holdings, Inc. (NASDAQ: EVLV), recently announced a new free-of-charge AI-led UX site assessment feature to boost online conversions in eCommerce. Delivered as an emailed report that gives insight into where site owners’ digital experiences are underperforming, the new feature provides prioritized, contextual UX recommendations to help businesses advance.

“Our free UX site assessment feature is a game-changer for businesses looking to optimize their digital experiences but have limited resources for UX experimentation,” said Tyler Foster, President and CTO at Evolv AI. “Our recommendation engine distills generalized learnings from millions of experiments and extensive UX research to deliver custom, contextual recommendations to our end users. Our AI also predicts which UX improvements will yield the highest returns, so you can focus resources strategically.”

Back in March, MicroStrategy Incorporated (NASDAQ: MSTR) unveiled a new customizable AI bot called Auto that lets business users interact with MicroStrategy’s data analytics offerings through natural language. The new Auto software was based upon the MicroStrategy AI product suite that was launched last year, using generative AI technology to lower the technical skills required by users to consume data using MicroStrategy data analytics.

“Our modern cloud architecture, proven semantic graph, and robust APIs gave us the agility to lead the market with a solution that combines the latest generative AI with trusted BI,” said Saurabh Abhyankar, Chief Product Officer at MicroStrategy. “And now, with Auto added to MicroStrategy AI, we’re enabling customers to build and deploy custom AI bots in minutes. But this is just the beginning. We have dozens of new features underway for MicroStrategy AI that will help every organization capitalize on our vision for Intelligence Everywhere.”

MicroStrategy would follow up the launch of Auto, by unveiling enhancements to the platform at the end of April.

Working to further help enterprises interpret and utilize their data, leading enterprise automation and AI software company UiPath Inc. (NYSE: PATH) was recently recognized as a Leader in the Everest Group Process Mining Products PEAK Matrix Assessment 2024, marking the fifth consecutive year of UiPath receiving the honor.

“[UiPath’s] strong year-over-year growth in its process mining business, enhanced interoperability with its automation suite, and investments in product innovation and generative AI capabilities such as Autopilot have helped UiPath strengthen its position as a Leader and emerge as a Star Performer on Everest Group’s Process Mining Products PEAK Matrix® 2024,” said Amardeep Modi, Vice President at Everest Group. “Its product vision and roadmap, product’s ease of use, ability to visualize process maps and detect bottlenecks, and customer support are some of the key strengths highlighted by its clients.”

Serving to further enhance its portfolio, UiPath has also been linked to a $35.2 million investment in Paris-based AI startup Holistic, with plans to develop a “commercial relationship” with the company, according to a document filed at the start of May with the US Securities and Exchange Commission (SEC). The investment was part of a $200 million funding round for Holistic AI, as reported by Reuters.

Article Source: https://usanewsgroup.com/2024/04/26/the-currency-of-tomorrow-why-investing-in-cutting-edge-ai-recognition-tech-could-mean-big-money/

CONTACT:USA NEWS [email protected](604) 265-2873

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Scope AI Corp. advertising and digital media from the company directly. There may be 3rd parties who may have shares Scope AI Corp., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Scope AI Corp. which were purchased as a part of a private placement. MIQ reserves the right to buy and sell, and will buy and sell shares of Scope AI Corp. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements and/or investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

View original content:https://www.prnewswire.co.uk/news-releases/ai-revolution-accelerates-north-american-tech-companies-lead-amid-regulatory-changes-302181939.html

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days agoTech Developers Pioneering AI Tools to Revolutionize Future Productivity and Logistics

-

Uncategorized4 days ago

Uncategorized4 days agoDyspareunia Treatment Market to Hit $1,035.4 million by 2031, at a CAGR of 4.6%, says Coherent Market Insights

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days ago2024 World Intelligence Expo kicks off in Tianjin

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days ago2024 World Intelligence Expo Begins with a Grand Opening in Tianjin

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days agoKey Tech Stocks Optimizing AI Usability and Infrastructure for a $20-Trillion Future

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days agoEenovance Showcases Comprehensive Product Solutions at Intersolar Europe 2024

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days agoKidoodle MiniBox A1: Sowing Seeds of Imagination for Kids

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days agoTianjin Advances with AI