Artificial Intelligence

Alternative Financing Market to exceed $40 Bn by 2032, Says Graphical Research Powered by GMI

<!– Name:DistributionId Value:8845444 –> <!– Name:EnableQuoteCarouselOnPnr Value:False –> <!– Name:IcbCode Value:2790 –> <!– Name:CustomerId Value:1218110 –> <!– Name:HasMediaSnippet Value:false –> <!– Name:AnalyticsTrackingId Value:0fd6f68e-6ba4-4255-b7c3-0aaf72f43b90 –>

Selbyville, Delaware, May 24, 2023 (GLOBE NEWSWIRE) —

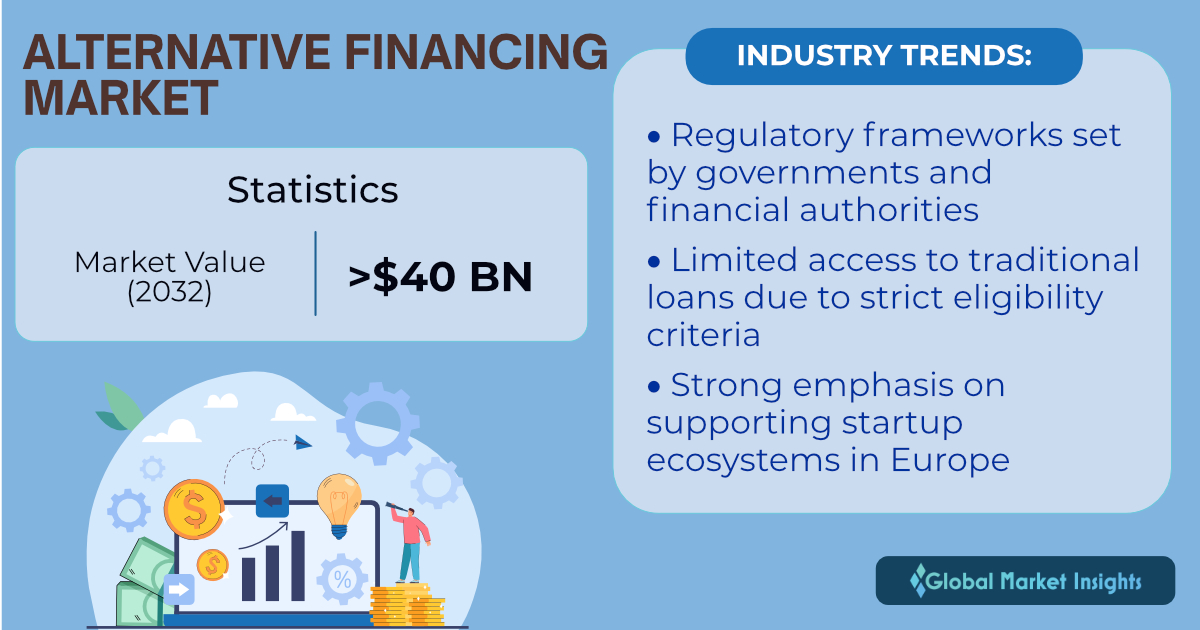

The alternative financing market valuation is expected to surpass USD 40 billion by 2032, as reported in a research study by Global Market Insights Inc.

Rapid advancements in technology, particularly in fintech, have revolutionized the financial industry. Alternative financing platforms leverage technology to provide efficient and user-friendly services, enabling borrowers and investors to connect directly without intermediaries. In addition, the popularity of online platforms and mobile apps that allow borrowers and investors to participate in alternative financing transactions from anywhere and anytime has boosted the business dynamics. Regulatory frameworks set by governments and financial authorities are also driving industry trends.

Request for a sample of this research report @ https://www.gminsights.com/request-sample/detail/5670

The alternative financing market from the crowdfunding segment will depict a remarkable CAGR from 2023 to 2032, owing to the growth of the internet and digital platforms. Crowdfunding platforms offer these technologies to create online marketplaces, connecting individuals or businesses seeking funding with potential investors. Moreover, the capability to provide a wide range of investment opportunities across various sectors and stages of business development is set to fuel product adoption.

The alternative financing market from the individual financing segment is likely to account for a prominent industry share by 2032, as a result of limited access to traditional loans due to strict eligibility criteria and a preference for faster processing times and more flexible terms. The peer-to-peer approach eliminates the need for traditional financial intermediaries, reduces costs, and allows borrowers to access loans quickly.

Europe alternative financing market will grow considerably through 2032. European regulatory bodies introduce measures to support and promote alternative financing options, such as the Capital Markets Union (CMU) initiative, which aims to harmonize regulations across EU member states and make it easier for businesses to access alternative financing sources. Furthermore, a strong regional focus on fostering innovation and supporting startup ecosystems will benefit the product outlook and has effectively increased the awareness of benefits and risks associated with alternative financing.

Make an inquiry for purchasing this report @ https://www.gminsights.com/inquiry-before-buying/5670

Prominent participants operating across the alternative financing industry are Credoc, Borrowers First, Finastra, GoFundMe, Funding Circle, Kickstarter, LendingClub, Kiva Microfunds, Upstart Network, Inc., Prosper Funding LLC, LendingCrowd, RateSetter, Quicken Loans (Rocket Mortgage, LLC), Sofi, and Zopa. They are adopting product diversification and business expansion tactics to stay ahead in the competitive scenario.

Alternative financing market news

- In January 2023, RateSetter’s division Metro Bank, entered the digital car loan market in the UK. With this, the company aims to use RateSetter’s peer-to-peer technology for its broker partners. The paperless application allows eligible borrowers to access their car on the same day. The companies aim to expand their presence in other parts of the world.

- In July 2022, Finastra, a financial services firm, introduced an embedded ‘alternative’ BNPL product that was intended to blend traditional regulated lending solutions with POS finance.

Partial chapters of report table of contents (TOC):

Chapter 2 Executive Summary

2.1 Alternative financing market 360º synopsis, 2018 – 2032

2.2 Business trends

2.2.1 Total Addressable Market (TAM)

2.3 Regional trends

2.4 Type trends

2.5 End use trends

Chapter 3 Alternative Financing Market Insights

3.1 Impact on COVID-19

3.2 Russia- Ukraine war impact

3.3 Industry ecosystem analysis

3.4 Vendor matrix

3.5 Profit margin analysis

3.6 Technology & innovation landscape

3.6.1 Blockchain

3.6.2 Artificial intelligence (AI)

3.7 Patent analysis

3.8 Key news and initiatives

3.9 Regulatory landscape

3.10 Impact forces

3.10.1 Growth drivers

3.10.1.1 Rising adoption of IOT and blockchain-based alternative financing platforms

3.10.1.2 Surge adoption of alternative finance

3.10.1.3 Lower operating cost of alternative financing

3.10.1.4 Increase in technology driven lenders

3.10.2 Industry pitfalls & challenges

3.10.2.1 Lack of awareness and understanding

3.11 Growth potential analysis

3.12 Porter’s analysis

3.13 PESTEL analysis

Browse our Reports Store – GMIPulse @ https://www.gminsights.com/gmipulse

Browse Related Reports:

Financial Analytics Market – By Component (Solution, Service), By Deployment Model (On-premise, Cloud), By Organization Size (SME, Large Enterprises), By Application, By End-use & Forecast, 2022-2030

https://www.gminsights.com/industry-analysis/financial-analytics-market

Wealth Management Platform Market Size By Advisory Mode (Human Advisory, Robo Advisory, Hybrid), By Deployment Model (On-premise, Cloud), Application, End-use & Global Forecast, 2023 – 2032

https://www.gminsights.com/industry-analysis/wealth-management-software-market

About Global Market Insights Inc.

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.

Artificial Intelligence

Saviynt Appoints James Ross as RVP-ANZ to Strategically Accelerate Growth in the Australia and New Zealand Region

LOS ANGELES, May 22, 2024 /PRNewswire/ — Saviynt, a leading provider of cloud-native identity and governance platform solutions, today announced the appointment of James Ross as RVP-ANZ as the company has seen rapid growth in the Australia and New Zealand (ANZ) region, with double digit growth year over year.

Saviynt has solidified its position as a key player in the cloud identity security landscape with its Identity Cloud. The company’s continued focus on innovation and client satisfaction has contributed significantly to building a safer Australia with prominent customers across the energy and utilities, finance, retail, energy, and transport and logistics sectors.

“James’ appointment as the Regional Vice President (RVP) for ANZ marks a strategic move to accelerate growth and solidify market presence in the region,” said Dan Mountstephen, SVP APAC at Saviynt. “With a proven track record of dynamic leadership at Collibra, ForgeRock, and CA Technologies, James brings a wealth of experience and expertise to the role. His visionary approach and collaborative spirit are poised to inspire and mobilize teams toward ambitious targets.”

Saviynt has consistently expanded its client base and deepened its relationships with existing customers through customized solutions and unparalleled support, cementing its reputation as a trusted partner in the region’s cybersecurity ecosystem. As RVP ANZ, Ross is set to foster key partnerships and implement agile strategies to propel the company towards new heights of success in the dynamic ANZ market.

“Joining Saviynt excites me because it’s an opportunity to help more organizations simplify their identity ecosystem in order to drive efficiencies and improved security posture. I am committed to leveraging Saviynt’s cutting-edge solutions to continue to broaden our partnerships in the region to improve our accessibility for customers, strengthen our regional delivery, whilst continuing to provide a great customer experience,” said Ross.

To learn more about Saviynt, please visit our website.

About Saviynt

Saviynt empowers enterprises to secure their digital transformation, safeguard critical assets, and meet regulatory compliance. With a vision to provide a secure and compliant future for all enterprises, Saviynt’s cutting-edge solutions have been recognized as industry leaders. For more information, please visit www.saviynt.com.

Press Contact

Jacklyn [email protected]

Photo: https://mma.prnewswire.com/media/2418209/James_Ross_RVP_ANZ_Saviynt.jpg

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/saviynt-appoints-james-ross-as-rvp-anz-to-strategically-accelerate-growth-in-the-australia-and-new-zealand-region-302151644.html

Artificial Intelligence

Appdome Sweeps Cybersecurity Excellence Awards

Unified Mobile Defense Platform Recognized for Innovation and Leadership Across Nine Cybersecurity Categories

REDWOOD CITY, Calif., May 21, 2024 /PRNewswire/ — Appdome, the mobile app economy’s one-stop shop for mobile defense, today announced it has received a total of nine (9) Cybersecurity Excellence Awards. The Appdome Unified Mobile App Defense Platform was awarded best in class across nine categories in recognition of the comprehensive breadth, depth and value of the Appdome platform to brands and enterprises alike.

“We congratulate Appdome on being recognized as an award winner in 9 categories of the 2024 Cybersecurity Excellence Awards,” said Holger Schulze, CEO of Cybersecurity Insiders and founder of the 600,000-member Information Security Community on LinkedIn, which organizes the 9th annual Cybersecurity Excellence Awards. “With over 600 entries across more than 300 categories, the awards are highly competitive. Appdome’s achievement reflects outstanding commitment to the core principles of excellence, innovation, and leadership in cybersecurity.”

Within a single pane of glass, Appdome delivers the most complete set of no-code, no-SDK, fully automated mobile defenses to mobile brands and enterprises, empowering mobile developers, cybersecurity, fraud and IT teams to deliver on any mobile cyber objective quickly and easily.

The nine (9) categories in which Appdome received a Cybersecurity Excellence Award are:

Mobile Security Platform: Appdome is the only enterprise-grade mobile security platform built for full mobile defense lifecycle management, visibility and control to brands and enterprises alike, including key features for build, test, release, monitor, response, and compliance automation. Mobile Security Automation: Appdome is the only mobile defense solution that uses machine learning to code and build over 300+ mobile app security, anti-fraud, anti-cheat, anti-malware, anti-bot, geo-compliance and other defenses in Android & iOS apps in the DevOps pipeline.Mobile Social Engineering Defense: The Appdome Social Engineering Prevention solution is the first of its kind to protect mobile users from voice phishing (Vishing) scams and other imposter scams, T.O.A.D. attacks, Remote Access Trojans (RATs), Gold Pickaxe, FaceID bypass and more without an SDK or external servers.Mobile Bot Defense: The Appdome MOBILEBot™ Defense solution is the first mobile anti-bot solution to come out of the box compatible with any industry standard web application firewall (WAF) on the market and provide multi-layered bot, credential stuffing and Account Take Over (ATO) defense without an SDK, external server, performance limits, or restrictions.Mobile Geo Compliance: Only the Appdome Mobile Geo-Compliance solution guarantees accurate and authentic geo location of mobile devices, applications and users without code or coding in the mobile app, without implementing an SDK and without deploying additional servers.Mobile XDR: The Appdome ThreatScope™ Mobile XDR solution is the only mobile attack and threat monitoring service that comes pre-packaged into the mobile defense lifecycle, requires no device agent, device profile, separate code, coding, SDK or server, and provides real-time detection and automated response across internal (employee facing) and external (consumer facing) Android & iOS apps.DevOps Mobile Security Tool: The Appdome platform’s fully integrated Security Release Management™ capabilities and Appdome Certified Secure™ mobile DevSecOps certification offer the only true enterprise-grade compliance assurance, audit and control for mobile defense at brands and enterprises, allowing quick verification that all security, anti-fraud and compliance objectives have been met. Mobile Application Security: With 300+ separate defenses for mobile apps, Appdome has the most comprehensive set of mobile application security features available in one product, fully compatible with all mobile Android & iOS apps.”Nine Cybersecurity Excellence Awards for Mobile Defense tells a very compelling story for the incredibly complex Dev, Sec, and Ops challenges organizations face detecting and defeating mobile-based risks and attacks,” said Chris Roeckl, Chief Product Officer at Appdome. “Point products make these challenges worse by adding complexity and overloading already taxed cyber and engineering teams. Appdome is the only platform simplifying work, bringing all these unique challenges under a single pane of glass, delivering 300+ protections and simultaneously resolving the security, fraud, resilience and compliance challenges brands and enterprises face.”

Learn more about the award-winning Appdome Platform at www.appdome.com or request a personalized demo at https://www.appdome.com/request-a-demo/appdome-home/

The full list of awards are available from the Cybersecurity Excellence Awards website https://cybersecurity-excellence-awards.com/

About AppdomeThe Appdome mission is to protect every mobile app and mobile user in the world. Appdome provides the mobile industry’s only Unified Mobile App Defense platform, powered by a patented mobile coding engine, Threat-Events™ Threat-Aware UX/UI Control, and ThreatScope™ Mobile XDR. Using Appdome, mobile brands eliminate complexity, ship faster and save money by delivering 300+ Certified Secure™ mobile app security, anti-malware, anti-fraud, mobile anti-bot, anti-cheat, geo compliance, MiTM attack prevention, code obfuscation, social engineering and other protections in Android and iOS apps with ease, inside the mobile DevOps and CI/CD pipeline. Leading financial, healthcare, government and m-commerce brands use Appdome to protect Android and iOS apps, mobile customers and mobile businesses globally. Appdome holds several patents including U.S. Patents 9,934,017 B2, 10,310,870 B2, 10,606,582 B2, 11,243,748 B2 and 11,294,663 B2. Additional patents pending.

Logo – https://mma.prnewswire.com/media/772169/AppDome_Logo_9_27_23.jpg

View original content:https://www.prnewswire.co.uk/news-releases/appdome-sweeps-cybersecurity-excellence-awards-302151786.html

Artificial Intelligence

Courageous Whistleblowers Reclaim Derogatory Terms As Data Shows 80% of Financial Professionals Stay Silent on Suspected Internal Fraud, Fearing Retaliation

Enron whistleblower, Sherron Watkins, alongside stars of Apple TV’s The Big Conn, Sarah Carver and Jennifer Griffith, reclaim derogatory labels for whistleblowers Concerning new data shows more than half of financial professionals in the UK and US have spotted or suspected internal fraud in their workplaces, yet four out of five stay silent fearing retaliation 32% of professionals in finance have seen whistleblowers victimized behind their back or to their faceJACKSONVILLE, Fla., May 21, 2024 /PRNewswire/ — New data from fraud detection software company Medius shows more than half of financial professionals in the UK and US (56%) have spotted or suspected internal fraud in their workplaces yet four in five (81%) stayed silent. When asked why, 45% of professionals cited the fear of recrimination.

Whistleblowers Sherron Watkins, Sarah Carver and Jennifer Griffith have joined forces to reclaim the derogatory names they were called after reporting serious internal financial fraud.

To help empower others to come forward, the whistleblowers are reclaiming the terms “snitch”, “rat” and “traitor”.

Sherron Watkins is the former Vice President of Enron Corporation who alerted the CEO to accounting irregularities, warning the organization “‘might implode in a wave of accounting scandals.” Watkins received national acclaim for her courageous actions and TIME magazine named her along with two others as their Persons of the Year in 2002, calling them simply ‘The Whistleblowers.’

Sarah Carver and Jennifer Griffith are the stars of Apple TV’s The Big Conn after they exposed a fraud scheme of more than $550 million while employed at the Social Security Administration. In efforts to silence their disclosures, they experienced multiple acts of severe retaliation and were denied protection. Ultimately, both Carver and Griffith were forced from employment.

Concerns of repercussions are vindicated – the survey reveals the extent to which financial professionals in the UK and US have witnessed negative consequences for whistleblowers firsthand:

59% have seen whistleblowers subsequently left out of important decisions 33% have seen whistleblowers moved to a different team 32% have heard whistleblowers called derogatory names behind their backs or directly to their faceWhen asked what would encourage them to flag suspicious activity, 93% of workers surveyed would feel more comfortable doing so if they had more evidence, yet nearly half (48%) said the legal system simply does not adequately protect whistleblowers.

Jim Lucier, CEO at Medius, a leading global provider of cloud-based accounts payable automation and spend management solutions, said:

“White collar crime is on the rise and no organization is safe. Employees are the last line of defense against fraud but confidence to report suspicious activity is declining. AI anomaly-detection technology can provide employees with the evidence and assurances they need to be more forthcoming. Building a culture where employees feel comfortable to report their suspicions could save organizations millions in the long-run.”

Medius works with over 4,000 customers across 102 countries and processes $200 billion in annual spend. It uses the power of AI and automation to detect fraud the moment invoices are submitted safeguarding against bad actors and potential threats, internal and external.

Sherron Watkins, whistleblower who was called a “snitch”, said: “When someone is troubled by corporate wrongdoing and they attempt to sound the alarm, the pathway is uncharted, things happen organically. Normal rational people speak about their concerns with their closest friends and work colleagues, who often suggest staying safe saying “keep your head down, if you must report, go soft, nothing black and white.” Yet black and white evidence is what is needed to get the attention of those in power, either internally or with media or outside watchdog groups to prevent or stop fraudulent activity.”

Jennifer Griffith, whistleblower who was called a “traitor”, said: “Choosing to blow the whistle involves more than just the desire to right a wrong. It’s about protecting their employers from fraud. However, it’s more often than not seen as causing trouble for the employer, or as a self-serving action to get a financial reward. No one who chooses to blow the whistle expects to have their reputation attacked, their credibility impugned or to lose their job. The cost of ignoring a whistleblowers complaints are far greater than acknowledging that a problem exists and taking steps to fix it. It’s been 19 years since I blew the whistle and the problems that existed then with the Social Security Administration still exist today. We must do more to protect whistleblowers.”

Sarah Carver, whistleblower who was called a “rat”, said: “The government’s attempt to conceal the fraud resulted in exacerbated damage, whereas a more prudent approach would have entailed immediate acknowledgement and rectification upon initial disclosure. The retaliatory measures aimed at silencing me made me stronger and fight harder to find someone to listen and stop the fraud.”

Georgina Hallford-Hall, CEO of Whistleblowers UK, said: “Too many organisations talk the talk but fail to engage with whistleblowers often at great cost to both. Technology used properly can remove the fear that both organisations and whistleblowers have about dealing with whistleblowing because it removes the person and focuses on the concerns or malfeasance. WhistleblowersUK are calling on the UK government to introduce an Independent Office of the Whistleblower to protect everyone from discrimination setting standards that end stigmatisation and discrimination making it safe to speak up.”

The billboard advertising campaign runs on Wall Street from Saturday, 18th May to Friday, 24th May 2024.

For more information about how Medius can prevent fraud, visit: https://www.medius.com/whistleblowing/

Notes to Editor

Methodology

The research was conducted by Censuswide with 1500 financial professionals in the UK and US (aged 18+) between 04/22/24 – 05/07/24. Censuswide abide by and employ members of the Market Research Society which is based on the ESOMAR principles and are members of The British Polling Council.

For more information, please contact:

Fight or Flight for [email protected] / +44 330 133 0985

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/medius/r/snitch—traitor—rat–courageous-whistleblowers-reclaim-derogatory-terms-as-data-shows-80–of-fina,c3985054

View original content:https://www.prnewswire.co.uk/news-releases/courageous-whistleblowers-reclaim-derogatory-terms-as-data-shows-80-of-financial-professionals-stay-silent-on-suspected-internal-fraud-fearing-retaliation-302151622.html

-

Artificial Intelligence5 days ago

Artificial Intelligence5 days agoJapan Data Center Market Investment to Reach $14.48 Billion by 2028 – Watch Out Exclusive Insight on Japan & Hong Kong Data Center Market – Arizton

-

Uncategorized4 days ago

Uncategorized4 days agoCoca-Cola: The future is ‘AI meets human ingenuity’

-

Uncategorized6 days ago

Uncategorized6 days agoGoogle to roll out AI-generated summaries at top of search engine

-

Artificial Intelligence5 days ago

Artificial Intelligence5 days agoStrava Unveils New Chapter of Accelerated Product Development at Brand’s Flagship Event

-

Artificial Intelligence4 days ago

Artificial Intelligence4 days agoMore than $9 Million Awarded to High School Scientists and Engineers at the Regeneron International Science and Engineering Fair 2024

-

Artificial Intelligence5 days ago

Artificial Intelligence5 days agoData Center Colocation Market Worth USD 58.4 Billion to 2031 – Exclusive Report by InsightAce Analytic Pvt. Ltd.

-

Artificial Intelligence6 days ago

Artificial Intelligence6 days agoIBM Expands Qiskit, World’s Most Performant Quantum Software

-

Uncategorized5 days ago

Uncategorized5 days agoSoftBank looks at ‘softening’ angry customer calls with AI