Artificial Intelligence

Volumetric Display Market Size Worth $705.9 Million by 2025 | CAGR: 28.5%: Grand View Research, Inc.

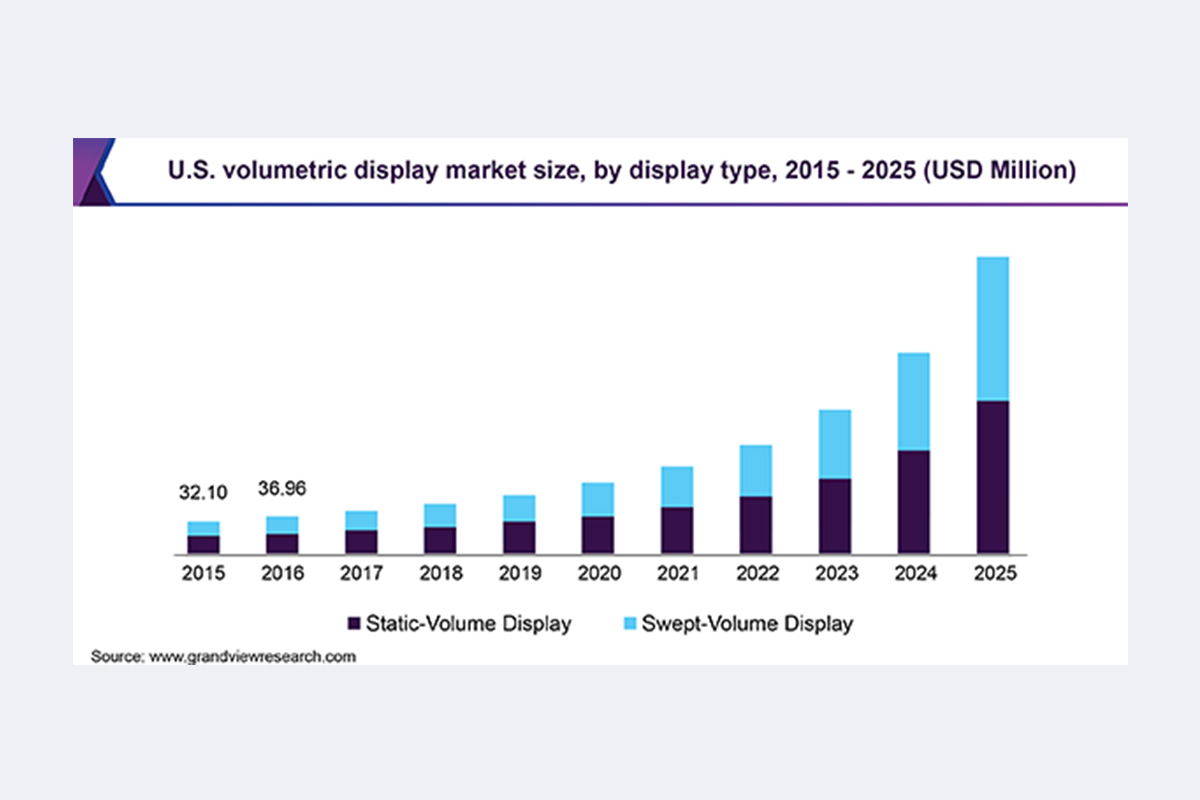

The global volumetric display market size is expected to reach USD 705.9 million by 2025, registering a CAGR of 28.5% over the forecast period, according to a study conducted by Grand View Research, Inc. Several in-built features such as visualization of holographic aerial images in free space, 360-degree spherical viewing angle, autostereoscopic capabilities, and motion-based depth cues are likely to drive the market over the forecast period.

Volumetric displays are widely preferred across several industries such as military and defense, healthcare, media, communication, entertainment, and aerospace owing to their built-in features. Massive investments in R&D by prominent market players such as LightSpace Technologies Inc. are estimated to create a significant opportunity for players to gain a substantial market share over the coming years. Moreover, these investments are majorly focused on improving overall in-built features of volumetric displays, which will cater to growing consumer demand for enhanced visual experiences during gaming and other applications. Robust deployment of 5G network infrastructure is further anticipated to spur the adoption of volumetric displays to provide seamless connectivity and enhanced experience to customers during video calls.

Key suggestions from the report:

- By type, the static volume segment captured the major market share in 2018 owing to its features such as aerial images in free space, 360-degree spherical viewing angle, and motion-based depth cues

- The swept volume segment is expected to witness rapid growth owing to significant investments by market players to develop advanced products within this category

- In 2018, the medical segment attained a market size of around USD 50.0 million and is estimated to register substantial growth owing to increasing adoption of this technology in healthcare for viewing 3D imaging by extracting stored data from Magnetic resonance imaging (MRI), Computed tomography (CT), and other systems

- North America accounted for the largest share in the global volumetric display market and is anticipated to exhibit the highest CAGR of more than 30.0% over the forecast period. The growth is due to rapidly increasing defense and healthcare spending to deploy modern technologies to obtain improved visualization during critical situations

- Companies are aggressively investing in R&D to develop new products with enhanced features to strengthen their market position and enhance their product portfolio

- Key players in the market include Lightspace Technologies Inc.; Voxon Photonics Pty Ltd.; The Coretec Group Inc.; and Holoxica Ltd.

Read 90 page research report with ToC on “Volumetric Display Market Size, Share & Trends Analysis Report By Display Type (Static Volume, Swept Volume), By End Use (Medical, Aerospace & Defense, Automotive), By Region, And Segment Forecasts, 2019 – 2025” at:

https://www.grandviewresearch.com/industry-analysis/volumetric-display-market

Advances in medical imaging technologies for more accurate diagnosis is expected to offer avenues for the market from 2019 to 2025. Use of volumetric displays in medical imaging applications to create real-time visualization of medical images enables a comprehensive acceptance of the technology across the industry. These are also used in several defense applications, such as visual representation of data related to situational awareness across the sea, space, land, and cyber space during simulation and training. Rapidly increasing defense spending for technological advancements in key countries such as U.S. and China, is also expected to propel the market growth over the forecast period.

Additionally, key market players are focusing on establishing partnerships and agreements with investors in order to raise funding to expand their market presence. However, high manufacturing costs owing to the intricate design of the product is expected to hinder the overall market growth in the coming years.

Grand View Research has segmented the global volumetric display market based on display type, end use, and region:

- Volumetric Display Type Outlook (Revenue, USD Million, 2015 – 2025)

- Static Volume Display

- Swept Volume Display

- Volumetric Display End-use Outlook (Revenue, USD Million, 2015 – 2025)

- Medical

- Aerospace & Defence

- Automotive

- Media, Communication, & Entertainment

- Education & Training

- Others (Oil & Gas, Mining, etc.)

- Volumetric Display Regional Outlook (Revenue, USD Million, 2015 – 2025)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of the World

- North America

Find more research reports on Display Technologies Industry, by Grand View Research:

- Quantum Dot (QD) Display Market – Increasing demand for optimized display devices with better resolution quality and performance has driven the adoption of QD technology across various consumer electronics application areas.

- Outdoor LED Display Market – Increasing demand for better resolution and affordable solutions is expected to drive the industry over the forecast period. The industry is characterized by rising trend towards interactive media.

- Head-Up Display Market – Number of shipments of Head-Up Display (HUD) in 2016 was estimated to 3.75 Million units and is expected to witness a significant increase in terms of volume over the forecast period.

SOURCE Grand View Research, Inc.

Artificial Intelligence

Identity Governance & Administration Market Projected to Reach $24.42 billion by 2030 – Exclusive Report by 360iResearch

PUNE, India, April 25, 2024 /PRNewswire/ — The report titled “Identity Governance & Administration Market by Component (Services, Solution), Modules (Access Certification & Compliance Control, Access Management, Identity Lifecycle Management), Organization Size, Deployment, Vertical – Global Forecast 2024-2030” is now available on 360iResearch.com’s offering, presents an analysis indicating that the market projected to grow from a size of $8.46 billion in 2023 to reach $24.42 billion by 2030, at a CAGR of 16.34% over the forecast period.

“Navigating Global Identity Governance With Key Strategies for Digital Security and Compliance”

Identity governance and administration (IGA) has emerged as a critical policy-driven approach aimed at fortifying digital identities within organizations, ensuring that proper access is provided to the right individuals for valid reasons. Across the globe, the demand for IGA solutions is on the rise, driven by the need to tackle sophisticated cyber threats, comply with stringent data protection laws, and adapt to the digitization wave sweeping through industries. Challenges include integrating these solutions with pre-existing IT frameworks, primarily in organizations reliant on legacy systems. The North American market, led by the United States and Canada, is at the forefront of this expansion, embracing technological advancements and stringent regulatory standards. Meanwhile, the Europe, Middle East, and Africa (EMEA) region is navigating its unique landscape, with the EU focusing heavily on compliance through GDPR and the Middle East and Africa gradually recognizing the value of digital security. The Asia-Pacific region is witnessing a significant uptrend in IGA solutions adoption, spurred by digital transformation initiatives and cybersecurity awareness, with China and India playing pivotal roles. This global perspective highlights the universal importance of IGA in today’s digital era, highlighting the critical balance between innovation, security, and regulatory compliance in safeguarding digital identities.

Download Sample Report @ https://www.360iresearch.com/library/intelligence/identity-governance-administration

“Navigating the New Normal With The Crucial Role of Identity Governance in Securing Hybrid Work Environments”

As businesses globally embrace the fusion of remote and traditional office work, the need for secure, hybrid workspaces becomes paramount. The shift toward flexible working models, accelerated by the COVID-19 pandemic, highlights the importance of cybersecurity and accessibility in ensuring operational continuity and a better work-life balance. Identity governance & administration (IGA) systems emerge as essential tools within this evolving work landscape. They enable organizations to manage digital identities and access rights effectively, safeguarding sensitive data against unauthorized access across diverse working environments. By ensuring that only credentialed employees can access critical information, regardless of their physical location, IGA solutions stand at the forefront of maintaining cybersecurity compliance and operational integrity. This development signifies a growing demand for robust identity governance frameworks, ensuring businesses remain resilient and secure in remote work and beyond.

“Elevating Security and Efficiency in Organizations through Specialized Identity Governance & Administration Services”

Managed and professional services provide organizations with the specialized expertise necessary for optimizing the performance and security of identity governance & administration (IGA) systems, eliminating the need for such in-depth knowledge internally. Businesses benefit from advanced skills that enhance system functionality and safeguard sensitive data by outsourcing specific IGA tasks. From the initial stages of integration and implementation, ensuring seamless incorporation with existing infrastructures, to ongoing support and maintenance for consistent system reliability and up-to-dateness, these services form the foundation of effective IGA strategies. Furthermore, training and consulting play a pivotal role, equipping companies with the understanding and capability to utilize their IGA systems to the fullest. IGA solution is a critical technological tool designed to streamline the management of user access rights across organizations, bolstering security, operational efficiency, and compliance with regulatory standards. This comprehensive approach to IGA facilitates a more secure, efficient, and compliant organizational environment, empowering businesses to focus on core objectives and ensure their data remains protected.

Request Analyst Support @ https://www.360iresearch.com/library/intelligence/identity-governance-administration

“International Business Machines Corporation at the Forefront of Identity Governance & Administration Market with a Strong 7.09% Market Share”

The key players in the Identity Governance & Administration Market include Broadcom, Inc., SAP SE, Oracle Corporation, Microsoft Corporation, International Business Machines Corporation, and others. These prominent players focus on strategies such as expansions, acquisitions, joint ventures, and developing new products to strengthen their market positions.

“Introducing ThinkMi: Revolutionizing Market Intelligence with AI-Powered Insights for the Identity Governance & Administration Market”

We proudly unveil ThinkMi, a cutting-edge AI product designed to transform how businesses interact with the Identity Governance & Administration Market. ThinkMi stands out as your premier market intelligence partner, delivering unparalleled insights with the power of artificial intelligence. Whether deciphering market trends or offering actionable intelligence, ThinkMi is engineered to provide precise, relevant answers to your most critical business questions. This revolutionary tool is more than just an information source; it’s a strategic asset that empowers your decision-making with up-to-the-minute data, ensuring you stay ahead in the fiercely competitive Identity Governance & Administration Market. Embrace the future of market analysis with ThinkMi, where informed decisions lead to remarkable growth.

Ask Question to ThinkMi @ https://app.360iresearch.com/library/intelligence/identity-governance-administration

“Dive into the Identity Governance & Administration Market Landscape: Explore 197 Pages of Insights, 654 Tables, and 26 Figures”

PrefaceResearch MethodologyExecutive SummaryMarket OverviewMarket InsightsIdentity Governance & Administration Market, by ComponentIdentity Governance & Administration Market, by ModulesIdentity Governance & Administration Market, by Organization SizeIdentity Governance & Administration Market, by DeploymentIdentity Governance & Administration Market, by VerticalAmericas Identity Governance & Administration MarketAsia-Pacific Identity Governance & Administration MarketEurope, Middle East & Africa Identity Governance & Administration MarketCompetitive LandscapeCompetitive PortfolioInquire Before Buying @ https://www.360iresearch.com/library/intelligence/identity-governance-administration

Related Reports:

Privileged Identity Management Market – Global Forecast 2024-2030Identity & Access Management Professional Services Market – Global Forecast 2024-2030Digital Identity Solutions Market – Global Forecast 2024-2030About 360iResearch

Founded in 2017, 360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset — our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

Contact 360iResearchMr. Ketan Rohom360iResearch Private Limited,Office No. 519, Nyati Empress,Opposite Phoenix Market City,Vimannagar, Pune, Maharashtra,India – 411014.Email: [email protected]: +1-530-264-8485India: +91-922-607-7550

To learn more, visit 360iresearch.com or follow us on LinkedIn, Twitter, and Facebook.

Logo: https://mma.prnewswire.com/media/2359256/360iResearch_Logo.jpg

View original content:https://www.prnewswire.co.uk/news-releases/identity-governance–administration-market-projected-to-reach-24-42-billion-by-2030—exclusive-report-by-360iresearch-302126089.html

Artificial Intelligence

Enghouse Video Partners With SONIFI Health To Deliver Advanced Telehealth Solutions In Hospital Rooms

MARKHAM, ON, April 25, 2024 /PRNewswire/ — Enghouse Video, a global leader in cutting-edge video technology solutions, today announced its partnership with SONIFI Health, enhancing virtual care in hospital settings.

SONIFI Health is a leading U.S. healthcare technology company based in Sioux Falls, South Dakota. The new partnership leverages and integrates Enghouse Video room systems technology to support SONIFI Health’s commitment to expanding telehealth applications and system optimizations in hospital settings.

Enghouse’s VidyoRooms solution, a sophisticated video conferencing technology that combines both software and hardware solutions, has been fully integrated into SONIFI Health’s interactive TV systems. This integration provides up to 4K high-quality video conferencing, multi-party sessions and robust security features that ensure full compliance with healthcare regulations.

Enghouse Video offers an immersive telehealth platform to support collaborative interdisciplinary care, improved patient outcomes and cost savings. The platform is flexible and simple, delivering the reliability, interoperability, and scalability needed for today’s healthcare environment. A key strength of the partnership is its offering of back-end integrations like patient portals, medical devices, EMR, tele-sitting, remote patient observation and consultation.

“Hospitals can choose the telehealth partner that’s right for them, and we incorporate that solution with interactive TV,” said Brian Nido, SONIFI Health’s Vice President of Customer Success. “Using the hardware and systems they already have in patient rooms helps hospitals reduce costs and maximize the value of their existing investments, while benefiting both clinicians and patients.”

SONIFI Health and Enghouse Video continue to collaborate closely to further refine and enhance the telehealth solutions provided to healthcare facilities. This partnership reflects a shared commitment to leveraging technology to create smarter hospital rooms and improve patient care across the healthcare spectrum.

About Enghouse VideoEnghouse Video, part of the Enghouse Interactive division, is a subsidiary of Enghouse Systems Limited, a vertically focused software and services company traded on the Toronto Stock Exchange (TSX: ENGH). Through highly secure, scalable and flexible Cloud-based or On Prem services, we deliver one of the world’s highest quality and most innovative video platform to video-enable any application or idea. From advanced video conferencing and collaboration tools to state-of-art enterprise video management, Enghouse Video is a unique player in multiple markets, including telehealth. Learn more at www.enghousevideo.com, read our blog, or follow us on Twitter at @EnghouseVideo, on LinkedIn, and on Facebook.

About SONIFI HealthSONIFI Health provides market-leading interactive patient engagement technology proven to improve patient outcomes and staff productivity. The EHR-integrated platform is designed to enhance patient and family experiences while increasing staff satisfaction and organizations’ operational efficiencies. As part of SONIFI Solutions, Inc., the company annually supports more than 300 million end user experiences. Learn more at sonifihealth.com.

Enghouse Video Contact: Sylvain Awad, Director, Demand Generation, Enghouse Video, part of Enghouse Interactive Division, [email protected]

View original content:https://www.prnewswire.co.uk/news-releases/enghouse-video-partners-with-sonifi-health-to-deliver-advanced-telehealth-solutions-in-hospital-rooms-302126882.html

Artificial Intelligence

Global Insurance Provider Selects 3CLogic to Streamline AI and Contact Center Capabilities with ServiceNow

Multinational Insurance Broker to deploy 3CLogic’s solution with ServiceNow’s Financial Service Operations (FSO) platform to streamline customer experiences.

ROCKVILLE, Md., April 25, 2024 /PRNewswire/ — 3CLogic, the leading Conversational AI and Contact Center solution for ServiceNow®, today announced its selection by a global insurance provider to replace its existing contact center infrastructure as part of a larger CX transformation effort. The strategic decision is designed to complement the organization’s use of ServiviceNow’s Financial Services Operations (FSO) offering leveraged across a number of its existing product lines including Customer Warranty Claims, Roadside Assistance, and Home Warranties.

Serving millions of customers worldwide with innovative insurance and protective products, the organization required a solution that would enhance its recent investment in the ServiceNow platform as it works to transform its end-to-end customer service operations. The deployment will incorporate several of 3CLogic’s AI-powered capabilities purpose-built for ServiceNow, including Conversational AI, Speech Analytics, and AI Performance & Coaching, along with integrated call transcriptions, convenient 2-way SMS, and ServiceNow-centralized contact center reporting.

“We continue to see enterprises eager to complement their existing investment in digital platforms, such as ServiceNow, with contact center features purpose-built to extend the workflows and features they already have and use,” explains Matt Durkin, VP of Global Sales at 3CLogic. “It’s no secret that organizations are already juggling too many systems, often with overlapping capabilities, which impacts ROI and operational efficiency. We’re proud to offer an alternative approach that helps simplify the technology stack while optimizing the overall operational costs and outcomes.”

Recently named to Constellation Research’s 2024 Shortlist for Digital Customer Service and Support, 3CLogic has seen global adoption of its solution by leading enterprises in healthcare, manufacturing, travel, retail, higher education, finance, non-profits, and Managed Service Providers across five continents. As a ServiceNow-certified Technology and Build partner with offerings available for ServiceNow’s IT Service Management, Customer Workflows, HR Service Delivery, and Source-to-Pay solutions, the company will be unveiling its latest set of capabilities at ServiceNow’s annual Knowledge 2024 event this May in Las Vegas.

For more information, please contact [email protected].

About 3CLogic3CLogic transforms customer and employee experiences with its leading Cloud Contact Center and AI solutions purpose-built to enhance today’s leading CRM and Customer Service Management platforms. Globally available and leveraged by the world’s leading brands, its offerings empower enterprise organizations with innovative features such as intelligent self-service, generative and Conversational AI, agent automation & coaching, and AI-powered sentiment analytics – all designed to lower operational costs, maximize ROI, and optimize each interaction across IT Service Desks, Customer Support, Sales or HR Services teams. For more information, please visit www.3clogic.com.

Logo – https://mma.prnewswire.com/media/2318845/3CLogic_logo.jpg

View original content:https://www.prnewswire.co.uk/news-releases/global-insurance-provider-selects-3clogic-to-streamline-ai-and-contact-center-capabilities-with-servicenow-302127739.html

-

Uncategorized7 days ago

Uncategorized7 days agoGenerative AI gold rush drives IT spending — with payoff in question

-

Uncategorized7 days ago

Uncategorized7 days agoDo underwriters trust artificial intelligence?

-

Uncategorized7 days ago

Uncategorized7 days agoHans Jonas on Responsibility in the Age of Artificial Intelligence

-

Uncategorized7 days ago

Uncategorized7 days agoMeta AI Assistant Adds Website, Expands Beyond US

-

Artificial Intelligence7 days ago

Artificial Intelligence7 days agoFree Your Hands, QIDI Vida Smart AR Glasses Lead the Way in New Sports Experience.

-

Uncategorized7 days ago

Uncategorized7 days agoCan artificial intelligence reduce vehicle time to market?

-

Uncategorized7 days ago

Uncategorized7 days agoThe Ottawa Hospital doctors to try AI for patient notes

-

Artificial Intelligence6 days ago

Artificial Intelligence6 days agoAurionpro Solutions acquires Arya.ai, to power next generation Enterprise AI platforms for Financial Institutions